Question: 2 0 2 4 During 2 0 2 4 the purchasing manager was able to negotiate for all the inventories to be purchased on credit

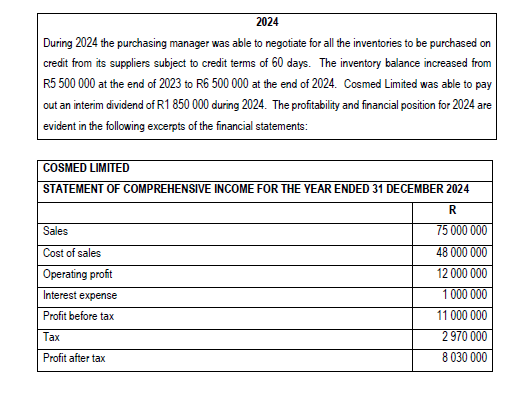

During the purchasing manager was able to negotiate for all the inventories to be purchased on credit from its suppliers subject to credit terms of days. The inventory balance increased from R at the end of to R at the end of Cosmed Limited was able to pay out an interim dividend of R during The profitability and financial position for are evident in the following excerpts of the financial statements: COSMED LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED DECEMBER R Sales Cost of sales Operating profit Interest expense Profit before tax Tax Profit after tax Refer to the statement of comprehensive income for the year ended December statement of financial position as at December and additional information related to the financial year. REQUIRED Calculate the ratios for fully stated to two decimal places eg:; that would reflect each of the following and comment on your answers. Use only the formulas provided in the formula sheet that appear after Question or in the module guide. An indication of the profitability of the company after the cost of goods sold have been deducted. Note: A ratio of was achieved in marks The amount of time the company takes to pay its suppliers after purchasing goods and services on credit. marks A measure of the profitability of the companys own and borrowed capital investment. marks The ability of the company to pay its shortterm obligations using only its most liquid assets. marks An indication of the companys profitability per share. Note: A ratio of cents per share was achieved in marks The percentage of the profit that has been put back into the company. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock