Question: 2 : 0 6 AM Wed Nov 2 0 . LTE ( 7 % Amp - Apps Training detail: Curriculu | hrblock.csod.com 2 Test -

: AM Wed Nov

LTE

Amp Apps

Training detail: Curriculu

hrblock.csod.com

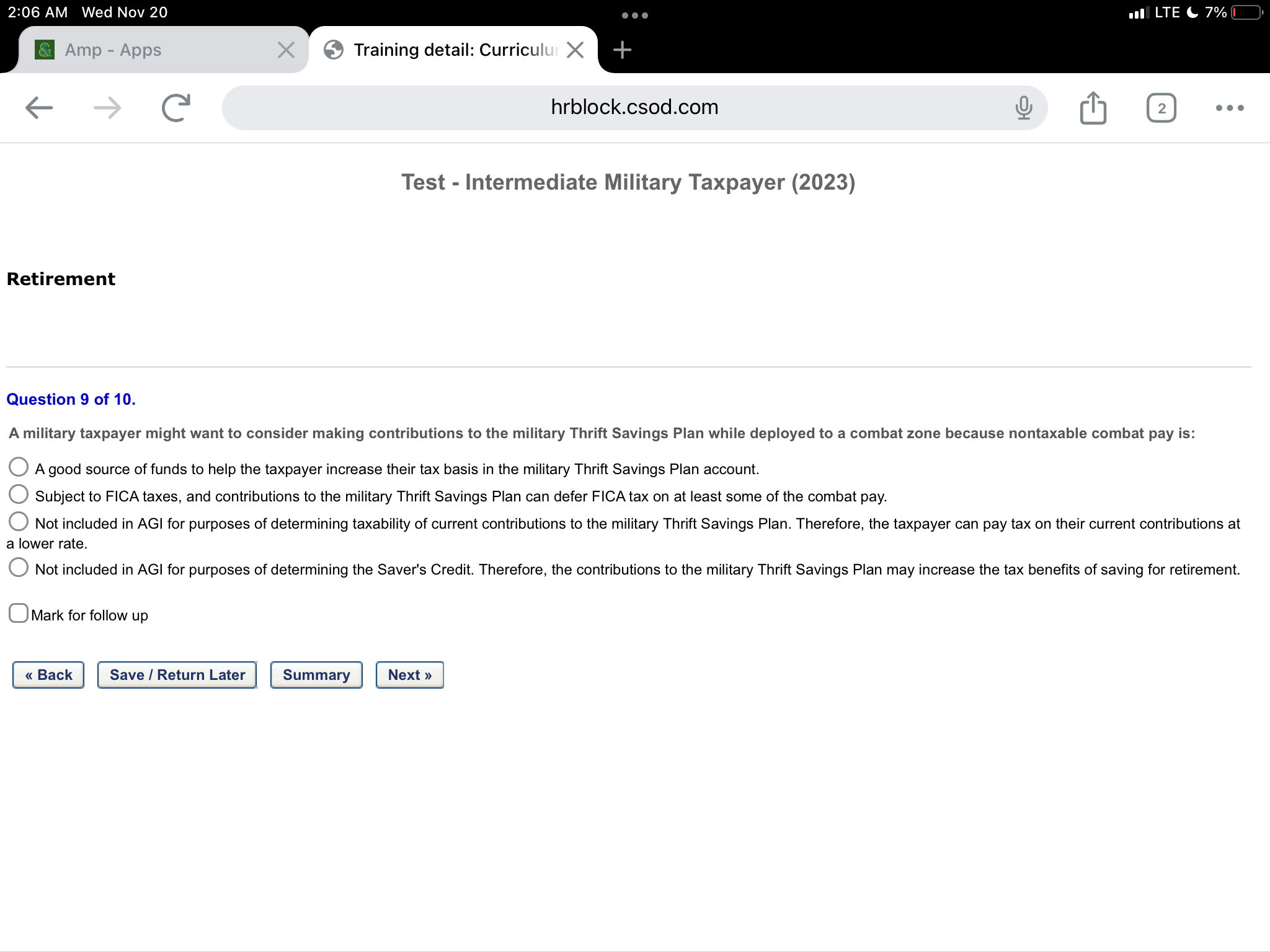

Test Intermediate Military Taxpayer

Retirement

Question of

A military taxpayer might want to consider making contributions to the military Thrift Savings Plan while deployed to a combat zone because nontaxable combat pay is:

A good source of funds to help the taxpayer increase their tax basis in the military Thrift Savings Plan account.

Subject to FICA taxes, and contributions to the military Thrift Savings Plan can defer FICA tax on at least some of the combat pay.

Not included in AGI for purposes of determining taxability of current contributions to the military Thrift Savings Plan. Therefore, the taxpayer can pay tax on their current contributions at a lower rate.

Not included in AGI for purposes of determining the Saver's Credit. Therefore, the contributions to the military Thrift Savings Plan may increase the tax benefits of saving for retirement.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock