Question: 2 0 8 0 1 : 3 7 : 2 5 If you use your car for both business and pleasure, the Canada Revenue Agency

::

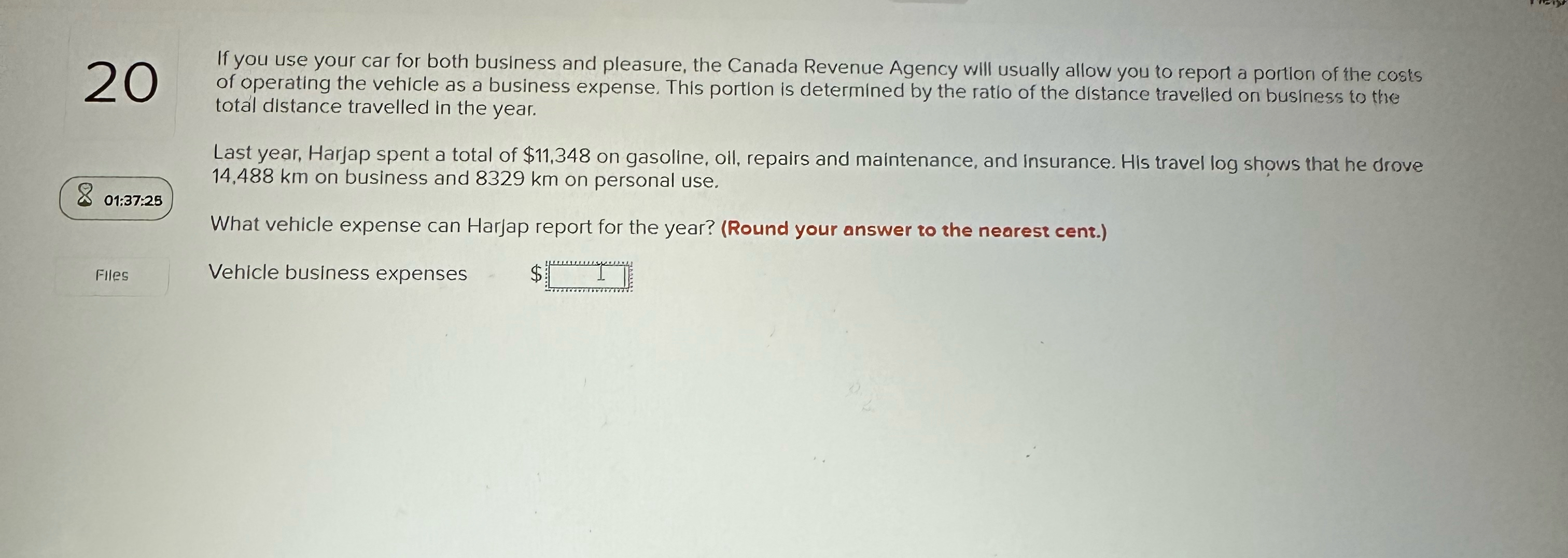

If you use your car for both business and pleasure, the Canada Revenue Agency will usually allow you to report a portion of the costs of operating the vehicle as a business expense. This portion is determined by the ratio of the distance travelled on business to the total distance travelled in the year.

Last year, Harjap spent a total of $ on gasoline, oll, repairs and maintenance, and insurance. His travel log shows that he drove on business and on personal use.

What vehicle expense can Harjap report for the year? Round your answer to the nearest cent.

Flles

Vehicle business expenses

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock