Question: 2 / 1 0 1 0 0 % Answer ALL the questions. [ 1 0 0 MARKS ] QUESTION 1 ( 2 0 Marks )

Answer ALL the questions.

MARKS

QUESTION

Marks

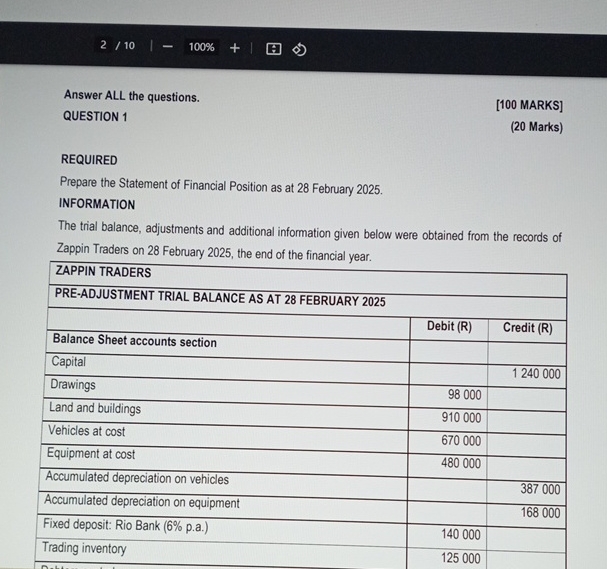

REQUIRED

Prepare the Statement of Financial Position as at February

INFORMATION

The trial balance, adjustments and additional information given below were obtained from the records of Zappin Traders on February the end of the financial year.

tableZAPPIN TRADERSPREADJUSTMENT TRIAL BALANCE AS AT FEBRUARY Debit RCredit RBalance Sheet accounts section,,CapitalDrawingsLand and buildings,Vehicles at costEquipment at costAccumulated depreciation on vehicles,,Accumulated depreciation on equipment,,Fixed deposit: Rio Bank paTrading inventory,

tableDebtors control,Provision for bad debts,,BankCash float,Creditors control,,Mortgage loan: Rio Bank paNominal accounts section,,SalesCost of sales,Sales returns,Salaries and wages,Bad debts,

tableStationeryRates and taxes,Motor expenses,Repairs to building,TelephoneElectricity and water,Bank charges,InsuranceInterest on mortgage loan,Interest on fixed deposit,,Rent income,,

Adjustments and additional information

The electricity and water account for February R was due to be paid on March

A debtor was declared insolvent. His insolvent estate paid of his debt of R and this has been recorded. The balance of his account must now be written off.

Stocktaking on February revealed the following inventories:

Trading inventory R

Stationery R

The provision for bad debts must be decreased to R

Rent has been received up to March

andAnalysisSupplementaryOSApdf

Rent has been received up to March

The insurance total includes an amount of R that was paid for the next financial year.

Provide for the outstanding interest on the mortgage loan for February Repayments during the next financial year are expected to reduce the loan balance by R Interest in not capitalised.

Provide for the outstanding interest on fixed deposit, R The fixed deposit matures on February Interest is not capitalised.

The credit purchase of tyres for a motor vehicle has not been recorded, RNote: Do not treat this as accrued expensesexpenses payable.

Provide for depreciation as follows:

On equipment at pa on cost

On vehicles, R

The net profit for the year ended February was R after taking the above into account.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock