Question: 2. (10 marks) (Replication and bounds) Assume that discount bonds maturing at T have time-0 price 1.5 per unit. Assume that T-expiry standard European calls

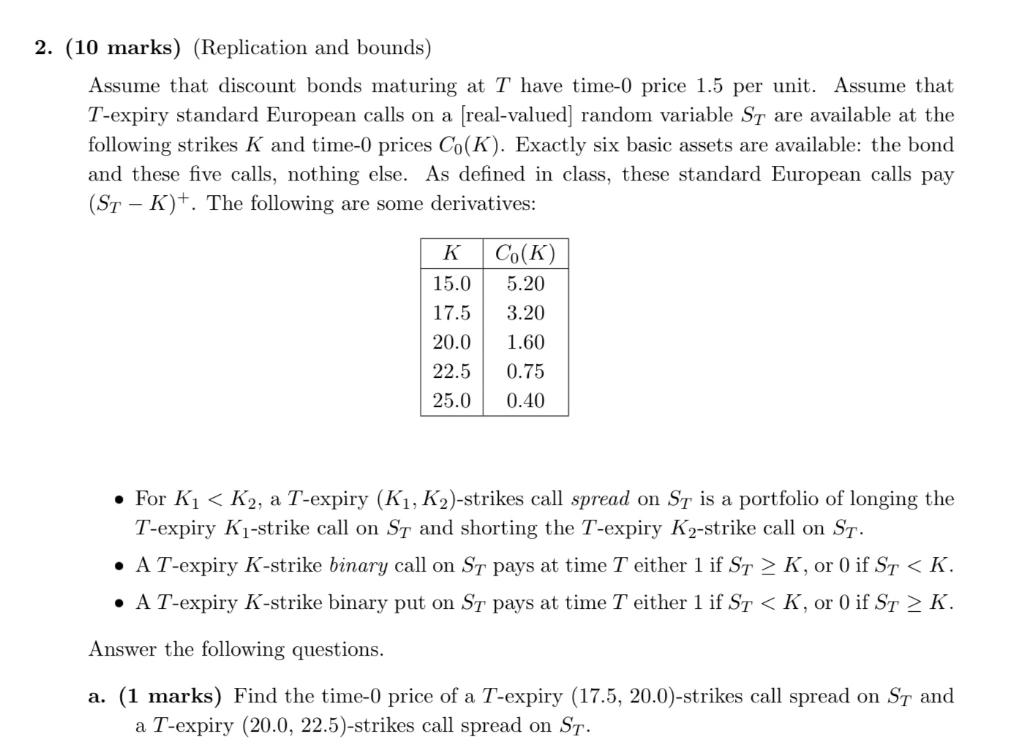

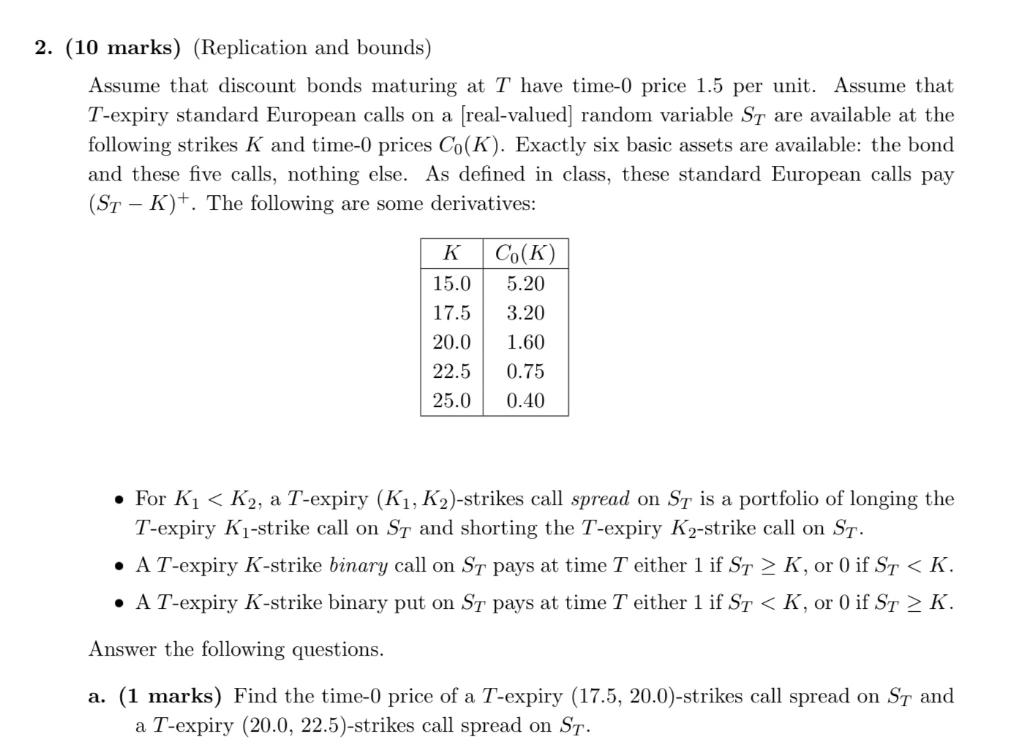

2. (10 marks) (Replication and bounds) Assume that discount bonds maturing at T have time-0 price 1.5 per unit. Assume that T-expiry standard European calls on a (real-valued) random variable St are available at the following strikes K and time-0 prices Co(K). Exactly six basic assets are available: the bond and these five calls, nothing else. As defined in class, these standard European calls pay (ST - K)+. The following are some derivatives: K 15.0 17.5 20.0 22.5 25.0 Co(K) 5.20 3.20 1.60 0.75 0.40 For Ki K, or 0 if ST K. Answer the following questions. a. (1 marks) Find the time-0 price of a T-expiry (17.5, 20.0)-strikes call spread on St and a T-expiry (20.0, 22.5)-strikes call spread on St. b. (3 marks) Use part (a) to find the upper and lower bounds on the time-0 price of a T- expiry 20-strike binary call on St. You should find a static "superreplicating" portfolio to obtain an upper bound, and a static "subreplicating" portfolio to obtain a lower bound. c. (3 marks) Find upper and lower bounds on the time-0 price of a T-expiry 20-strike binary put on ST. d. (3 marks) Find the time-0 price of a security which pays (5 - ST-201)+ at time T. Hints and Tips for Question 2 In general, when you are given a set of basic assets and asked to price or value a "derivative", this means to assign a price to the derivative in such a way that a frictionless "extended market consisting of the basic assets together with the derivative (at your proposed price] would admit no arbitrage If the derivative can be perfectly replicated by the basic assets, then we showed in lecture that the unique no-arbitrage price of the derivative is the value of the replicating portfolio. For example, this was the case in L6.17, where the derivative was a forward contract, and the basic assets were the underlying S and the bond Z. If the derivative cannot be perfectly replicated by the basic assets, then there is a range of prices that could be assigned to the derivative, all of which would be consistent with no- arbitrage. For example, this was the case in L6.22, where the derivative was a call, and the basic assets were the underlying non-dividend-paying stock S and the bond Z, and we considered only static "buy-and-hold") portfolios. We could not exactly replicate the call payoff and find a unique price. Instead, what we did, as shown in the diagram, was to super- replicate the call payoff using St, and to subreplicate the call payoff using St-K (and also using the zero payoff). By no-arbitrage, we concluded that the time-0 value of the call is bounded above by the superreplicating portfolio's time-0 value, and bounded below by the subreplicating portfolios' time-0 values. So there was not a unique price, but there was a range of no-arbitrage prices that had upper and lower bounds, expressible in terms of the prices of the basic assets. In Question 2, the basic assets are the five (standard) calls and the bond. The derivative in question depends on what part of the problem you are doing. For the derivative in Question 2(a)-(d), perfect replication is possible. For the derivatives in Question 3(b, c), perfect repli- cation is impossible (unless you make further assumptions such as assuming dynamics for Sr but I am not allowing you to make such extra assumptions). Suggestions: Draw a payoff diagram, like the ones we did in class. Include both the derivative's payoff and your super/sub]-replicating portfolio's payoff (as we did in class), to make sure that your proposed portfolio really does (super/sub]-replicate. In parts (b)-(e), you do not need to show that your bounds are tight. However, bounds which are not tight will lose some credit. Tight means that they cannot be improved (lowered in the case of an upper bound, raised in the case of a lower bound) without making further assumptions. 2. (10 marks) (Replication and bounds) Assume that discount bonds maturing at T have time-0 price 1.5 per unit. Assume that T-expiry standard European calls on a (real-valued) random variable St are available at the following strikes K and time-0 prices Co(K). Exactly six basic assets are available: the bond and these five calls, nothing else. As defined in class, these standard European calls pay (ST - K)+. The following are some derivatives: K 15.0 17.5 20.0 22.5 25.0 Co(K) 5.20 3.20 1.60 0.75 0.40 For Ki K, or 0 if ST K. Answer the following questions. a. (1 marks) Find the time-0 price of a T-expiry (17.5, 20.0)-strikes call spread on St and a T-expiry (20.0, 22.5)-strikes call spread on St. b. (3 marks) Use part (a) to find the upper and lower bounds on the time-0 price of a T- expiry 20-strike binary call on St. You should find a static "superreplicating" portfolio to obtain an upper bound, and a static "subreplicating" portfolio to obtain a lower bound. c. (3 marks) Find upper and lower bounds on the time-0 price of a T-expiry 20-strike binary put on ST. d. (3 marks) Find the time-0 price of a security which pays (5 - ST-201)+ at time T. Hints and Tips for Question 2 In general, when you are given a set of basic assets and asked to price or value a "derivative", this means to assign a price to the derivative in such a way that a frictionless "extended market consisting of the basic assets together with the derivative (at your proposed price] would admit no arbitrage If the derivative can be perfectly replicated by the basic assets, then we showed in lecture that the unique no-arbitrage price of the derivative is the value of the replicating portfolio. For example, this was the case in L6.17, where the derivative was a forward contract, and the basic assets were the underlying S and the bond Z. If the derivative cannot be perfectly replicated by the basic assets, then there is a range of prices that could be assigned to the derivative, all of which would be consistent with no- arbitrage. For example, this was the case in L6.22, where the derivative was a call, and the basic assets were the underlying non-dividend-paying stock S and the bond Z, and we considered only static "buy-and-hold") portfolios. We could not exactly replicate the call payoff and find a unique price. Instead, what we did, as shown in the diagram, was to super- replicate the call payoff using St, and to subreplicate the call payoff using St-K (and also using the zero payoff). By no-arbitrage, we concluded that the time-0 value of the call is bounded above by the superreplicating portfolio's time-0 value, and bounded below by the subreplicating portfolios' time-0 values. So there was not a unique price, but there was a range of no-arbitrage prices that had upper and lower bounds, expressible in terms of the prices of the basic assets. In Question 2, the basic assets are the five (standard) calls and the bond. The derivative in question depends on what part of the problem you are doing. For the derivative in Question 2(a)-(d), perfect replication is possible. For the derivatives in Question 3(b, c), perfect repli- cation is impossible (unless you make further assumptions such as assuming dynamics for Sr but I am not allowing you to make such extra assumptions). Suggestions: Draw a payoff diagram, like the ones we did in class. Include both the derivative's payoff and your super/sub]-replicating portfolio's payoff (as we did in class), to make sure that your proposed portfolio really does (super/sub]-replicate. In parts (b)-(e), you do not need to show that your bounds are tight. However, bounds which are not tight will lose some credit. Tight means that they cannot be improved (lowered in the case of an upper bound, raised in the case of a lower bound) without making further assumptions