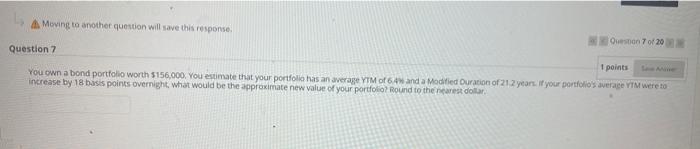

Question: 2 1. A Moving to another question will save this response Oeste 7 of 20 Question 7 1 points You own a bond portfolio worth

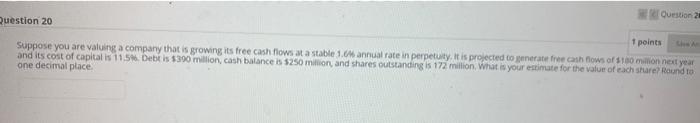

A Moving to another question will save this response Oeste 7 of 20 Question 7 1 points You own a bond portfolio worth $156,000. You estimate that your portfolio has an average YTM of 6 and a Modified Duration of 212 years. If your portfolios average were to increase by 18 basis points overnight, what would be the approximate new value of your portfolio Round to the nearest dollar Question 2 Question 20 1 points Suppose you are valuing a company that is growing its free cash flows at a stable 1.6 annual rate in perpetuity. It is projected to eat free cash flows of 100 milion next year and its cost of capitalis 11.5Debt is $390 million, cash balance is $250 million, and shares outstanding is 172 million What is your estimate for the value of each sure Round to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts