Question: Hi. Can you please help me to answer this question 2 (a,b,c,d)? Please include all the needed diagrams such as payoff diagram. Thanks in advance!

Hi. Can you please help me to answer this question 2 (a,b,c,d)? Please include all the needed diagrams such as payoff diagram. Thanks in advance!

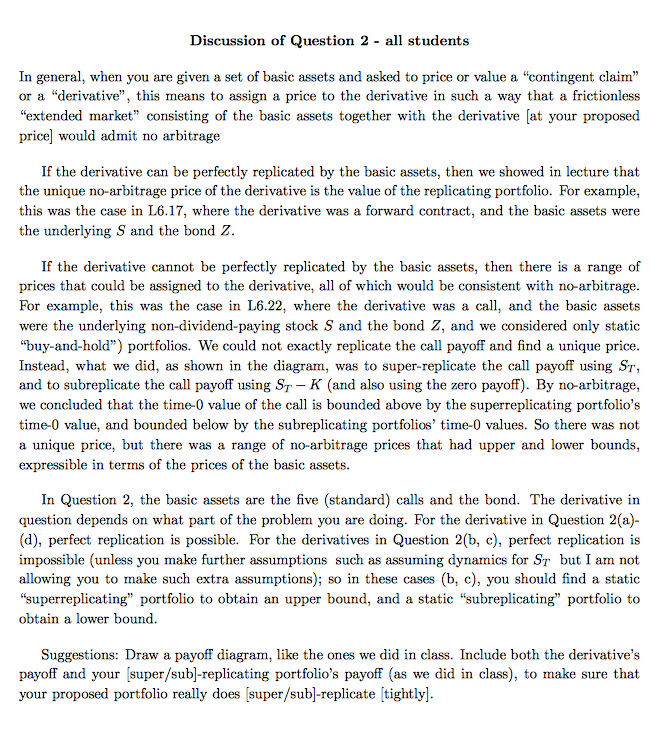

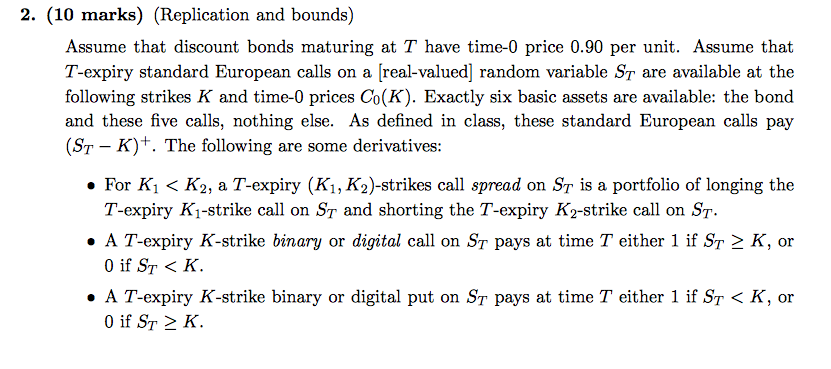

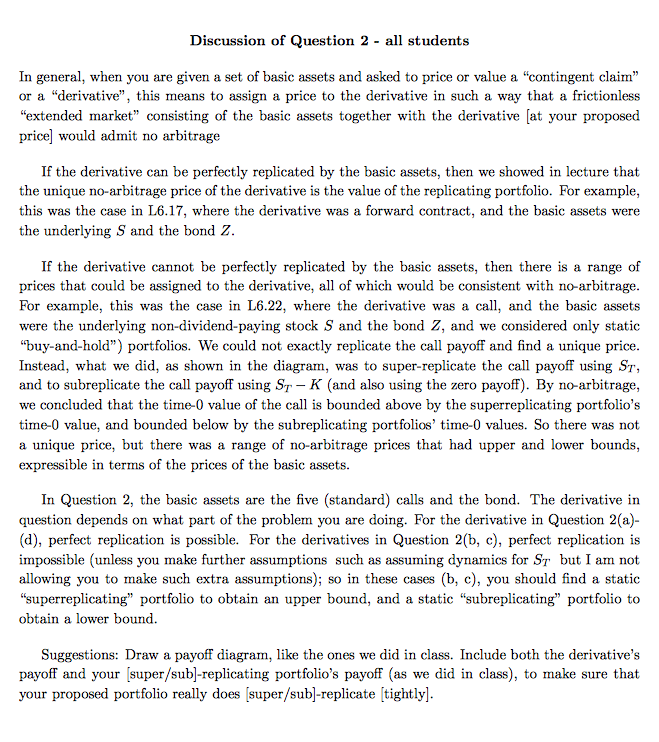

2. (10 marks) {Replication and bounds) Assume that discount bonds maturing at T have time-U price 0.90 per unit. Assume that T-expiry standard European calls on a [real-valued] random variable ST are available at the following strikes K and time-U prices COLE]. Exactly six basic assets are available: the bond and these ve calls, nothing else. As dened in class, these standard European calls pay [ST ~ K)+. The following are some derivatives: o For K1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts