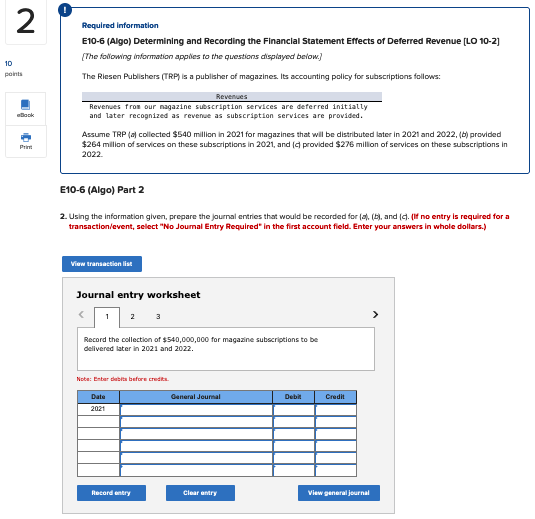

Question: 2 10 points eBook Print Required information E10-6 (Algo) Determining and Recording the Financial Statement Effects of Deferred Revenue [LO 10-2] [The following information

![the Financial Statement Effects of Deferred Revenue [LO 10-2] [The following information](https://s3.amazonaws.com/si.experts.images/answers/2024/05/665656cd698a2_349665656cd5ff75.jpg)

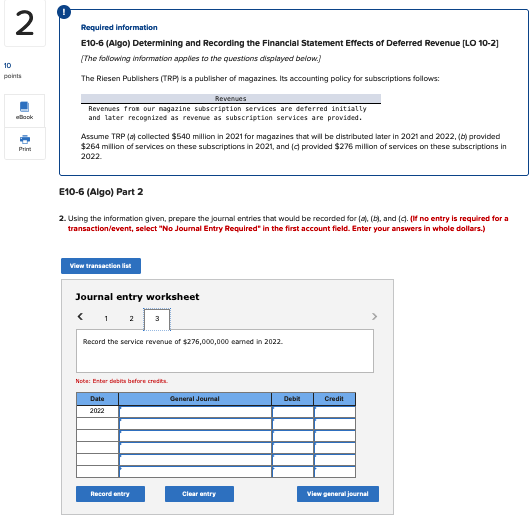

2 10 points eBook Print Required information E10-6 (Algo) Determining and Recording the Financial Statement Effects of Deferred Revenue [LO 10-2] [The following information applies to the questions displayed below.) The Riesen Publishers (TRP) is a publisher of magazines. Its accounting policy for subscriptions follows: Revenues Revenues from our magazine subscription services are deferred initially and later recognized as revenue as subscription services are provided. Assume TRP (a) collected $540 million in 2021 for magazines that will be distributed later in 2021 and 2022, (b) provided $264 million of services on these subscriptions in 2021, and (c) provided $276 million of services on these subscriptions in 2022. E10-6 (Algo) Part 2 2. Using the information given, prepare the journal entries that would be recorded for (a), (b), and (c). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 3 Record the collection of $540,000,000 for magazine subscriptions to be delivered later in 2021 and 2022. Note: Enter debits before credits. Date 2021 General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts