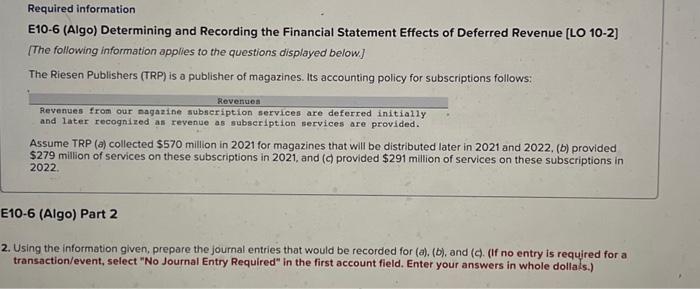

Question: Required information E10-6 (Algo) Determining and Recording the Financial Statement Effects of Deferred Revenue [LO 10-2] [The following information applies to the questions displayed below.]

![of Deferred Revenue [LO 10-2] [The following information applies to the questions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea61a23c1dd_44966ea61a1d5bd6.jpg)

![displayed below.] The Riesen Publishers (TRP) is a publisher of magazines. Its](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea61a2cada2_45066ea61a26c7bd.jpg)

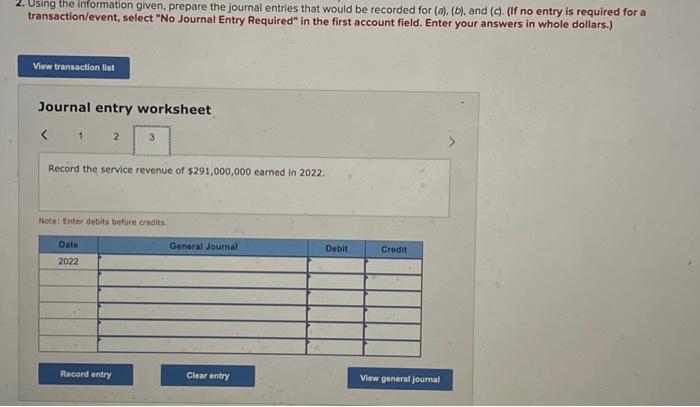

Required information E10-6 (Algo) Determining and Recording the Financial Statement Effects of Deferred Revenue [LO 10-2] [The following information applies to the questions displayed below.] The Riesen Publishers (TRP) is a publisher of magazines. Its accounting policy for subscriptions follows: Assume TRP (a) collected $570 million in 2021 for magazines that will be distributed later in 2021 and 2022, (b) provided $279 million of services on these subscriptions in 2021, and (c) provided $291 million of services on these subscriptions in 2022. 10.6 (Algo) Part 2 Using the information given, prepare the joumal entries that would be recorded for (a), (b), and (c). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollals.) Journal entry worksheet Record the collection of $570,000,000 for magazine subscriptions to be delivered later in 2021 and 2022. Note: Enter debits before credits. 2. Using the information given, prepare the journal entries that would be recorded for (a), (b), and (C). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollars.) Journal entry worksheet Record the service revenue of $279,000,000 earned in 2021 . Notei Enter debits before credits Using the information given, prepare the journal entries that would be recorded for (a), (b), and (c). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollars.) Journal entry worksheet Record the service revenue of $291,000,000 earned in 2022 . Note Lnter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts