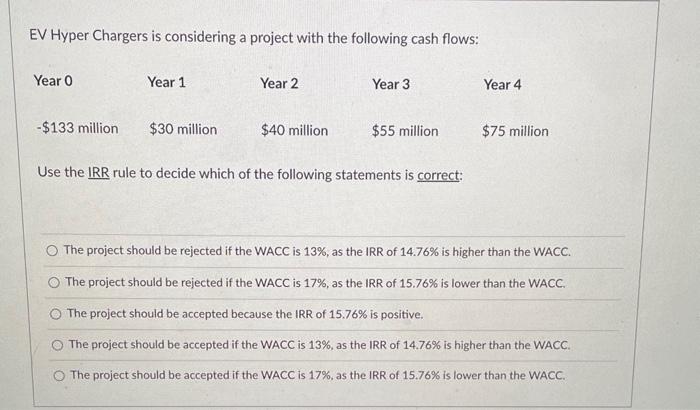

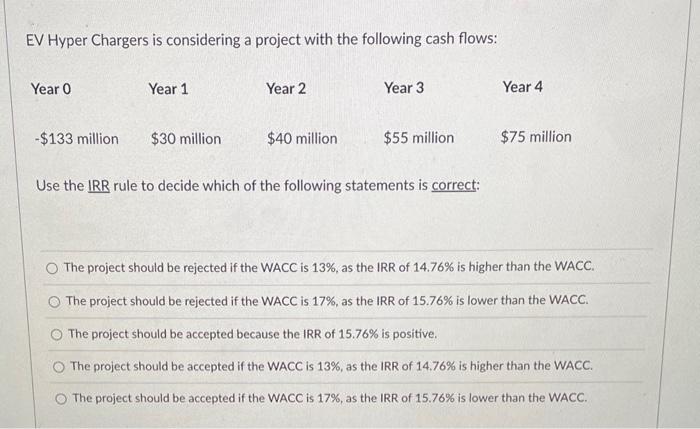

Question: 2 2 EV Hyper Chargers is considering a project with the following cash flows: Year 0 Year 1 Year 2 Year 3 Year 4 -

EV Hyper Chargers is considering a project with the following cash flows: Year 0 Year 1 Year 2 Year 3 Year 4 - \$133 million $30 million $40 million $55 million $75 million Use the IRR rule to decide which of the following statements is correct: The project should be rejected if the WACC is 13%, as the IRR of 14.76% is higher than the WACC The project should be rejected if the WACC is 17%, as the IRR of 15.76% is lower than the WACC. The project should be accepted because the IRR of 15.76% is positive. The project should be accepted if the WACC is 13%, as the IRR of 14.76% is higher than the WACC The project should be accepted if the WACC is 17%, as the IRR of 15.76% is lower than the WACC. EV Hyper Chargers is considering a project with the following cash flows: Year 0 Year 1 Year 2 Year 3 Year 4 - $133 million $30 million $40 million $55 million $75 million Use the IRR rule to decide which of the following statements is correct: The project should be rejected if the WACC is 13%, as the IRR of 14.76% is higher than the WACC. The project should be rejected if the WACC is 17%, as the IRR of 15.76% is lower than the WACC. The project should be accepted because the IRR of 15.76% is positive. The project should be accepted if the WACC is 13%, as the IRR of 14.76% is higher than the WACC. The project should be accepted if the WACC is 17%, as the IRR of 15.76% is lower than the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts