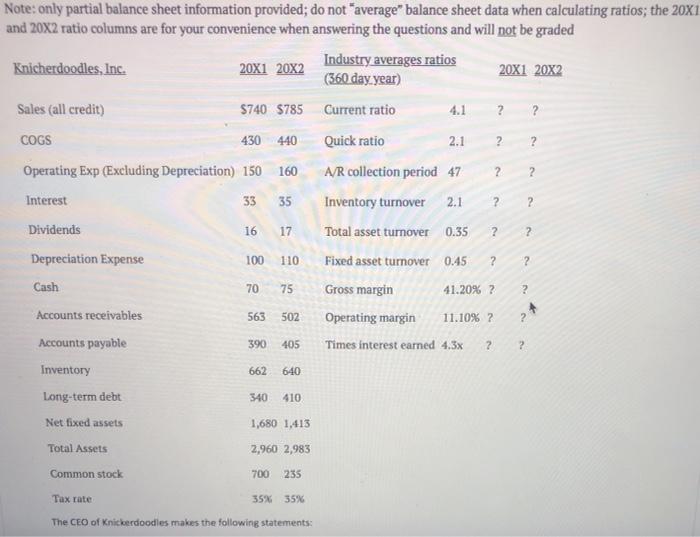

Question: 2 ? ? 2 ? ? ? Note: only partial balance sheet information provided; do not average balance sheet data when calculating ratios; the 20X1

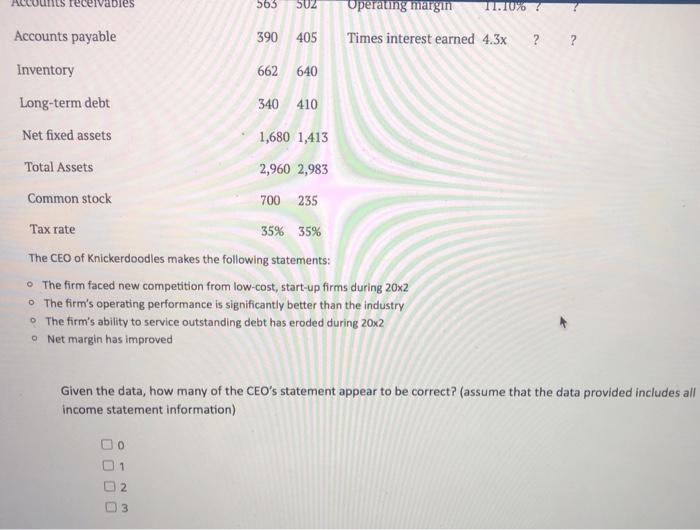

2 ? ? 2 ? ? ? Note: only partial balance sheet information provided; do not "average" balance sheet data when calculating ratios; the 20X1 and 20x2 ratio columns are for your convenience when answering the questions and will not be graded Knicherdoodles, Inc. 20X1 20X2 Industry averages ratios 2021 2022 (360 day.year) Sales (all credit) 5740 5785 Current ratio 4.1 COGS 430 440 Quick ratio 2.1 Operating Exp (Excluding Depreciation) 150 160 A/R collection period 47 Interest 33 35 Inventory turnover 2.1 ? Dividends Total asset turnover Depreciation Expense 100 110 Fixed asset turnover 75 Gross margin 41.20% ? Accounts receivables Operating margin 11.10%? Accounts payable 390 Times interest earned 4.3x Inventory Long-term debt Net fixed assets 1,680 1,413 Total Assets 2,960 2,983 16 17 0.35 ? 0.45 ? ? Cash 70 ? 563 502 ? 405 2 ? 662 640 340 410 Common stock 700 235 Tax rate 35% 35% The CEO of Knickerdoodles makes the following statements: eceivables 565 SUZ Operaung margin 11.10%? Accounts payable 390 405 Times interest earned 4.3x ? ? 662 640 Inventory Long-term debt Net fixed assets 340410 1,680 1,413 2,960 2,983 Total Assets Common stock 700 235 Tax rate 35% 35% The CEO of Knickerdoodles makes the following statements: The firm faced new competition from low-cost, start-up firms during 20x2 The firm's operating performance is significantly better than the industry The firm's ability to service outstanding debt has eroded during 20x2 Net margin has improved Given the data, how many of the CEO's statement appear to be correct? (assume that the data provided includes all income statement information) 0 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts