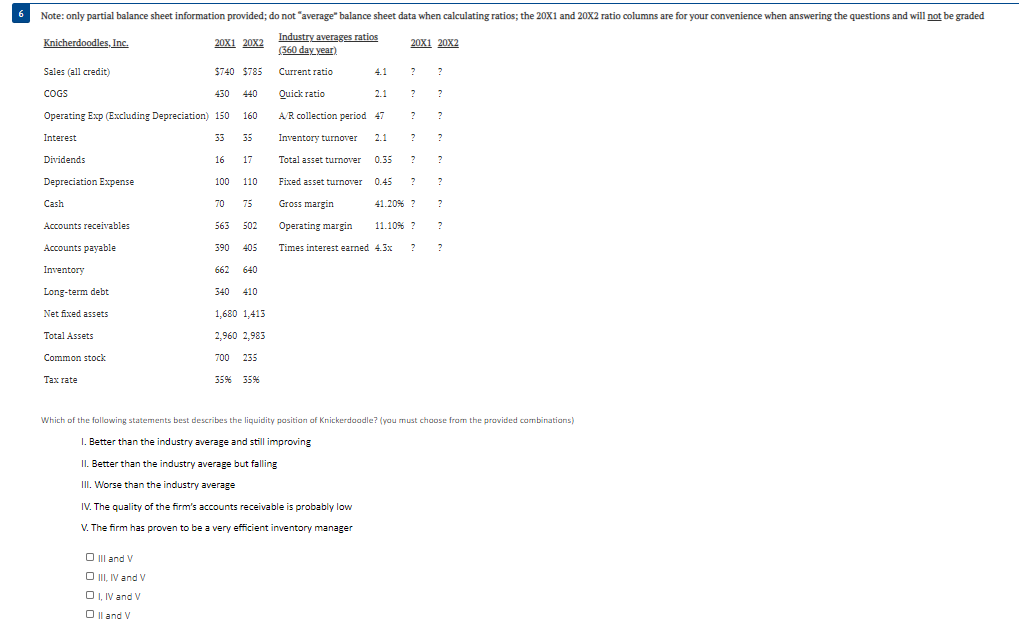

Question: Note: only partial balance sheet information provided; do not average balance sheet data when calculating ratios; the 20X1 and 20X2 ratio columns are for your

Note: only partial balance sheet information provided; do not average" balance sheet data when calculating ratios; the 20X1 and 20X2 ratio columns are for your convenience when answering the questions and will not be graded Knicherdoodles, Inc. 20X1 20X2 Industry averages ratios 20X1 20X2 ( 360 day_year) Sales (all credit) ) $740 $785 Current ratio ? COGS 450 Quick ratio 2.1 ? 2 2 440 A/R collection period 47 2 ? 3 2 Operating Exp (Excluding Depreciation) 150 160 Interest 55 55 Inventory turnover 2.1 ? ? 2 Dividends 16 17 Total asset turnover ? 2 2 Depreciation Expense 100 110 Fixed asset turnover 0.45 ? 2 2 Cash 70 75 Gross margin 41.20% ? ? 2 Accounts receivables 563 502 Operating margin 11.10%? 2 Accounts payable 590 405 Times interest eamed 4.3x 2 3 2 Inventory 662640 Long-term debt 340 410 Net fixed assets 1,680 1,413 Total Assets 2.960 2.985 Common stock 700 235 Tax rate 55% 35% Which of the following statements best describes the liquidity position of Knickerdaadle? (you must choose from the provided combinations) 1. Better than the industry average and still improving II. Better than the industry average but falling . III. Worse than the industry average IV. The quality of the firm's accounts receivable is probably low V. The firm has proven to be a very efficient inventory manager Ill and V O III IV and V OI, IV and V Oll and V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts