Question: 2. (20 points) (a) (5 points) Consider an asset with initial price Si = $275, with two possible prices for time T = 2: S2

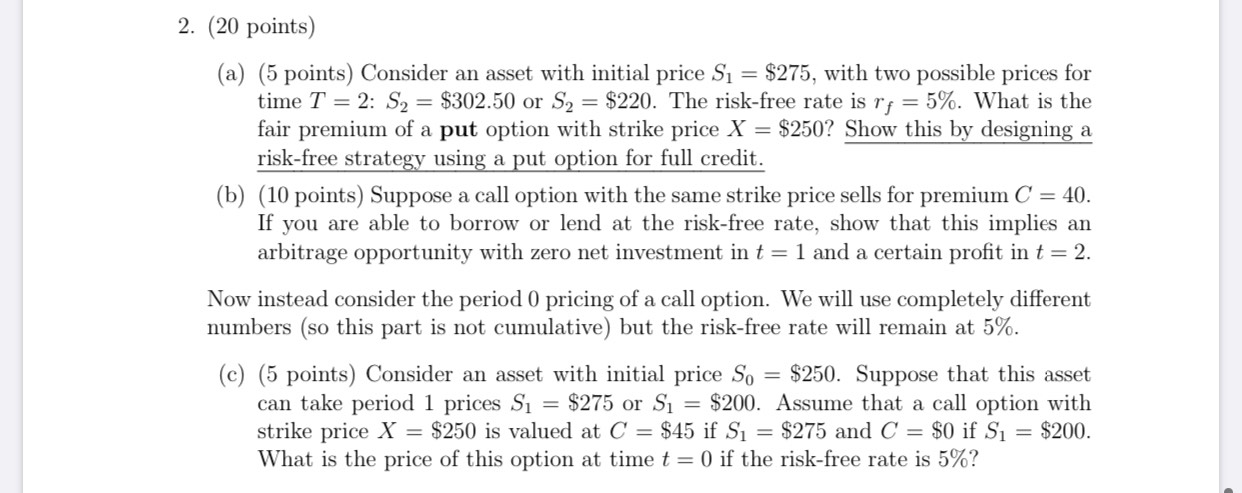

2. (20 points) (a) (5 points) Consider an asset with initial price Si = $275, with two possible prices for time T = 2: S2 = $302.50 or S2 = $220. The risk-free rate is ry = 5%. What is the fair premium of a put option with strike price X = $250? Show this by designing a risk-free strategy using a put option for full credit. (b) (10 points) Suppose a call option with the same strike price sells for premium C = 40. If you are able to borrow or lend at the risk-free rate, show that this implies an arbitrage opportunity with zero net investment in t = 1 and a certain profit in t = 2. Now instead consider the period 0 pricing of a call option. We will use completely different numbers (so this part is not cumulative) but the risk-free rate will remain at 5%. (c) (5 points) Consider an asset with initial price So = $250. Suppose that this asset can take period 1 prices Si = $275 or Si = $200. Assume that a call option with strike price X = $250 is valued at C = $45 if Si = $275 and C = $0 if Si = $200. What is the price of this option at time t = 0) if the risk-free rate is 5%? 2. (20 points) (a) (5 points) Consider an asset with initial price Si = $275, with two possible prices for time T = 2: S2 = $302.50 or S2 = $220. The risk-free rate is ry = 5%. What is the fair premium of a put option with strike price X = $250? Show this by designing a risk-free strategy using a put option for full credit. (b) (10 points) Suppose a call option with the same strike price sells for premium C = 40. If you are able to borrow or lend at the risk-free rate, show that this implies an arbitrage opportunity with zero net investment in t = 1 and a certain profit in t = 2. Now instead consider the period 0 pricing of a call option. We will use completely different numbers (so this part is not cumulative) but the risk-free rate will remain at 5%. (c) (5 points) Consider an asset with initial price So = $250. Suppose that this asset can take period 1 prices Si = $275 or Si = $200. Assume that a call option with strike price X = $250 is valued at C = $45 if Si = $275 and C = $0 if Si = $200. What is the price of this option at time t = 0) if the risk-free rate is 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts