Question: = 2. (20 points) Consider a two-period random interest rate binomial tree model. The stock prices are So = 4, 5= 8, SI = 2,

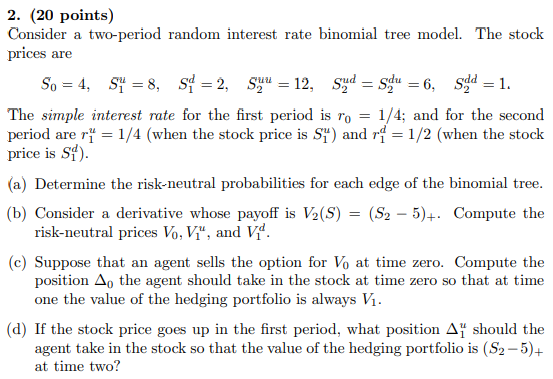

= 2. (20 points) Consider a two-period random interest rate binomial tree model. The stock prices are So = 4, 5= 8, SI = 2, su = 12, syd = squ = 6, sd = 1. The simple interest rate for the first period is ro = 1/4; and for the second period are r1 = 1/4 (when the stock price is $) and r1 = 1/2 (when the stock price is ). (a) Determine the risk-neutral probabilities for each edge of the binomial tree. (b) Consider a derivative whose payoff is V2(S) = (S2 5)+. Compute the risk-neutral prices Vo, V, and Vd. (c) Suppose that an agent sells the option for V, at time zero. Compute the position A, the agent should take in the stock at time zero so that at time one the value of the hedging portfolio is always Vi. (d) If the stock price goes up in the first period, what position A should the agent take in the stock so that the value of the hedging portfolio is (S2-5)+ at time two? = + = 2. (20 points) Consider a two-period random interest rate binomial tree model. The stock prices are So = 4, 5= 8, SI = 2, su = 12, syd = squ = 6, sd = 1. The simple interest rate for the first period is ro = 1/4; and for the second period are r1 = 1/4 (when the stock price is $) and r1 = 1/2 (when the stock price is ). (a) Determine the risk-neutral probabilities for each edge of the binomial tree. (b) Consider a derivative whose payoff is V2(S) = (S2 5)+. Compute the risk-neutral prices Vo, V, and Vd. (c) Suppose that an agent sells the option for V, at time zero. Compute the position A, the agent should take in the stock at time zero so that at time one the value of the hedging portfolio is always Vi. (d) If the stock price goes up in the first period, what position A should the agent take in the stock so that the value of the hedging portfolio is (S2-5)+ at time two? = +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts