Question: 2. (25 points) Consider a permanent disability model with three states: State 0: Healthy, State 1: Permanently disabled, and State 2: Dead. Suppose that Mon=0.04,

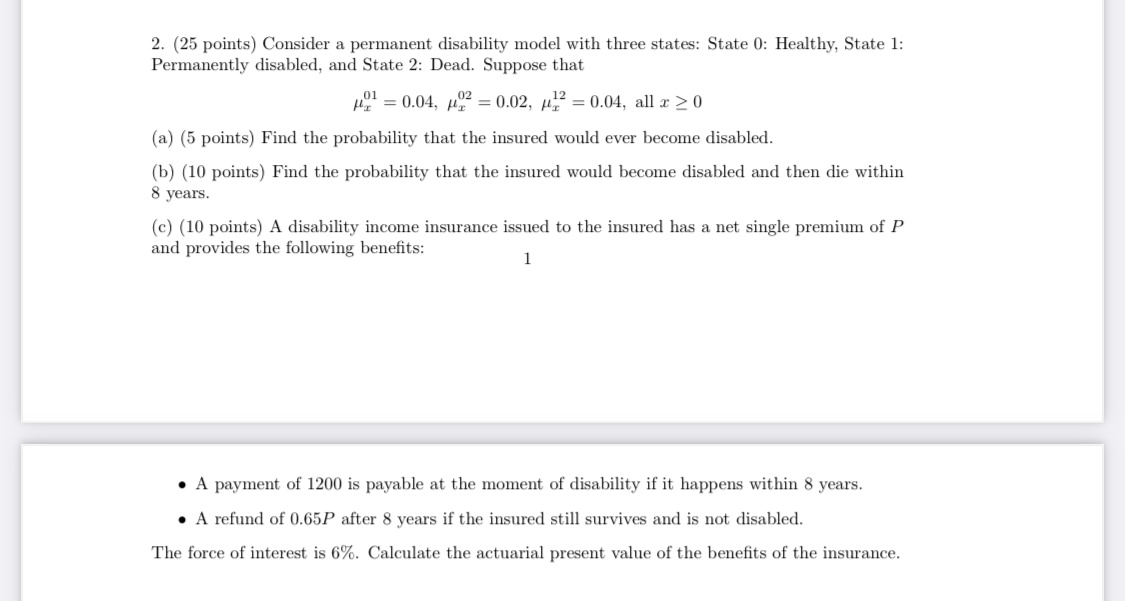

2. (25 points) Consider a permanent disability model with three states: State 0: Healthy, State 1: Permanently disabled, and State 2: Dead. Suppose that Mon=0.04, 2 = 0.02, 2 = 0.04, all x > 0 (a) (5 points) Find the probability that the insured would ever become disabled. (b) (10 points) Find the probability that the insured would become disabled and then die within 8 years. (c) (10 points) A disability income insurance issued to the insured has a net single premium of P and provides the following benefits: 1 A payment of 1200 is payable at the moment of disability if it happens within 8 years. A refund of 0.65P after 8 years if the insured still survives and is not disabled. The force of interest is 6%. Calculate the actuarial present value of the benefits of the insurance. 2. (25 points) Consider a permanent disability model with three states: State 0: Healthy, State 1: Permanently disabled, and State 2: Dead. Suppose that Mon=0.04, 2 = 0.02, 2 = 0.04, all x > 0 (a) (5 points) Find the probability that the insured would ever become disabled. (b) (10 points) Find the probability that the insured would become disabled and then die within 8 years. (c) (10 points) A disability income insurance issued to the insured has a net single premium of P and provides the following benefits: 1 A payment of 1200 is payable at the moment of disability if it happens within 8 years. A refund of 0.65P after 8 years if the insured still survives and is not disabled. The force of interest is 6%. Calculate the actuarial present value of the benefits of the insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts