Question: 2. 3. 4. Work together in your groups to solve the following problem. A couple will retire in 50 years; they plan to spend

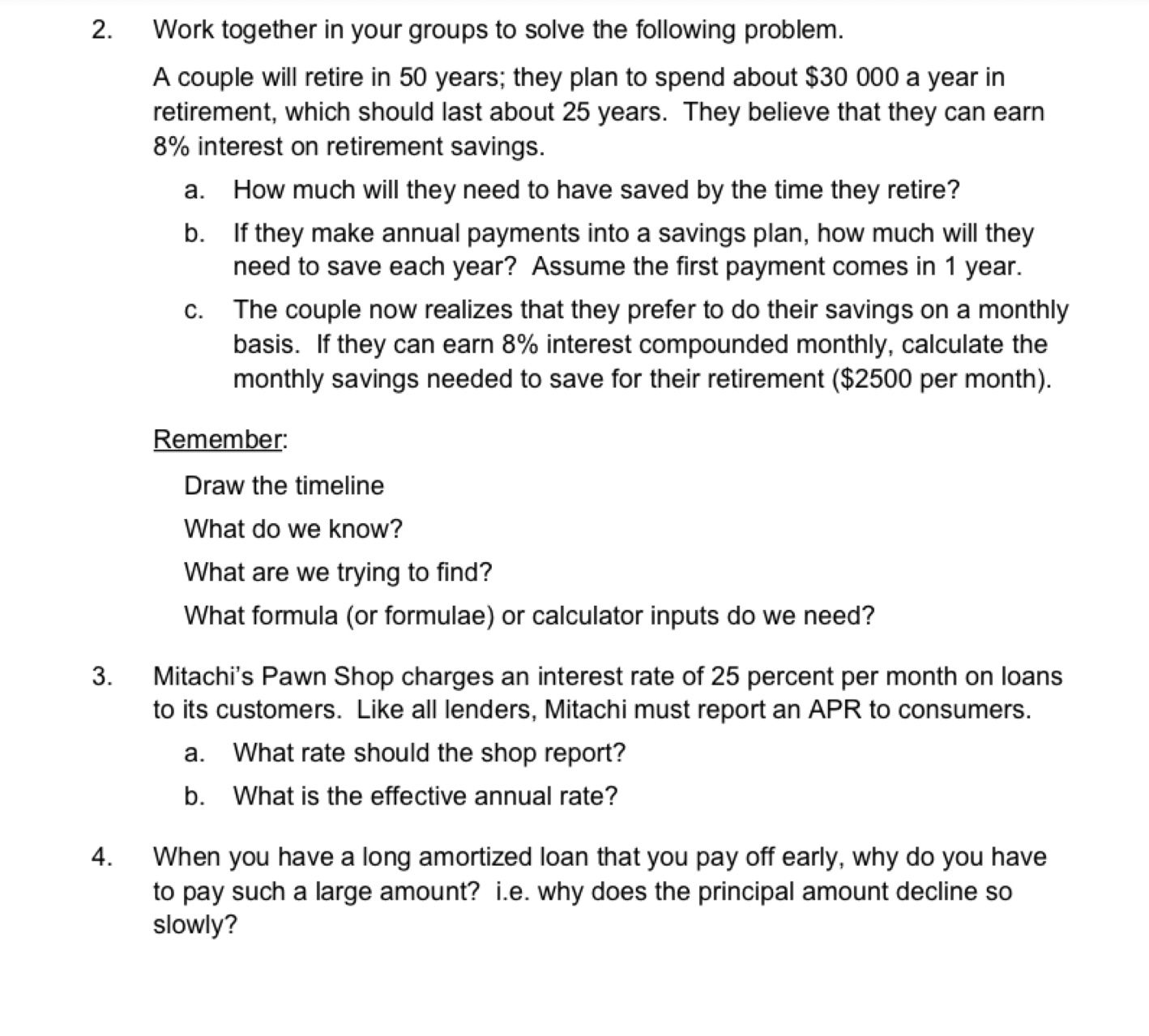

2. 3. 4. Work together in your groups to solve the following problem. A couple will retire in 50 years; they plan to spend about $30 000 a year in retirement, which should last about 25 years. They believe that they can earn 8% interest on retirement savings. a. How much will they need to have saved by the time they retire? b. If they make annual payments into a savings plan, how much will they need to save each year? Assume the first payment comes in 1 year. C. The couple now realizes that they prefer to do their savings on a monthly basis. If they can earn 8% interest compounded monthly, calculate the monthly savings needed to save for their retirement ($2500 per month). Remember: Draw the timeline What do we know? What are we trying to find? What formula (or formulae) or calculator inputs do we need? Mitachi's Pawn Shop charges an interest rate of 25 percent per month on loans to its customers. Like all lenders, Mitachi must report an APR to consumers. a. What rate should the shop report? b. What is the effective annual rate? When you have a long amortized loan that you pay off early, why do you have to pay such a large amount? i.e. why does the principal amount decline so slowly?

Step by Step Solution

There are 3 Steps involved in it

Problem 2 a How much will they need to have saved by the time they retire 1 Timeline Retirement in 50 years spend 30000 per year for 25 years 2 What w... View full answer

Get step-by-step solutions from verified subject matter experts