Question: 2 3 400,000 $12 Question 3 Firstmover Pte Ltd (Firstmover) is preparing to launch some new products in a new market unrelated to its current

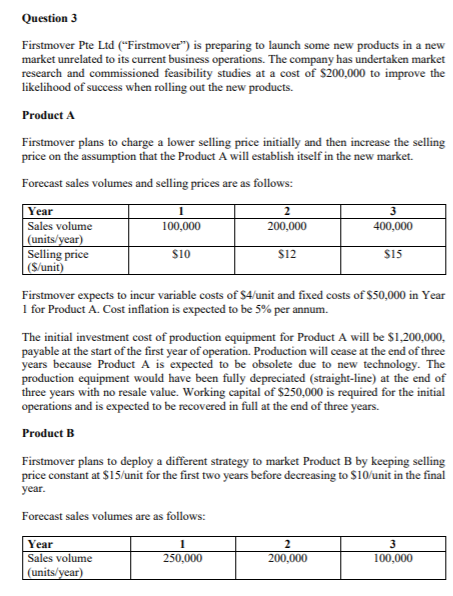

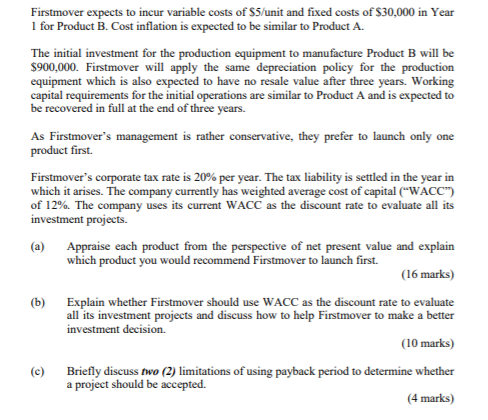

2 3 400,000 $12 Question 3 Firstmover Pte Ltd ("Firstmover") is preparing to launch some new products in a new market unrelated to its current business operations. The company has undertaken market research and commissioned feasibility studies at a cost of $200,000 to improve the likelihood of success when rolling out the new products. Product A Firstmover plans to charge a lower selling price initially and then increase the selling price on the assumption that the Product A will establish itself in the new market. Forecast sales volumes and selling prices are as follows: Year Sales volume 100,000 200,000 (units/year) Selling price $10 $15 (S/unit) Firstmover expects to incur variable costs of S4/unit and fixed costs of $50,000 in Year 1 for Product A. Cost inflation is expected to be 5% per annum. The initial investment cost of production equipment for Product A will be $1,200,000, payable at the start of the first year of operation. Production will cease at the end of three years because Product A is expected to be obsolete due to new technology. The production equipment would have been fully depreciated (straight-line) at the end of three years with no resale value. Working capital of $250,000 is required for the initial operations and is expected to be recovered in full at the end of three years. Product B Firstmover plans to deploy a different strategy to market Product B by keeping selling price constant at $15/unit for the first two years before decreasing to $10/unit in the final year. Forecast sales volumes are as follows: Year 2 3 Sales volume 250,000 200,000 100,000 (units/year) Firstmover expects to incur variable costs of $5/unit and fixed costs of $30,000 in Year 1 for Product B. Cost inflation is expected to be similar to Product A. The initial investment for the production equipment to manufacture Product B will be $900,000. Firstmover will apply the same depreciation policy for the production equipment which is also expected to have no resale value after three years. Working capital requirements for the initial operations are similar to Product A and is expected to be recovered in full at the end of three years. As Firstmover's management is rather conservative, they prefer to launch only one product first. Firstmover's corporate tax rate is 20% per year. The tax liability is settled in the year in which it arises. The company currently has weighted average cost of capital ("WACC") of 12%. The company uses its current WACC as the discount rate to evaluate all its investment projects. (a) Appraise each product from the perspective of net present value and explain which product you would recommend Firstmover to launch first. (16 marks) (b) Explain whether Firstmover should use WACC as the discount rate to evaluate all its investment projects and discuss how to help Firstmover to make a better investment decision (10 marks) (c) Briefly discuss two (2) limitations of using payback period to determine whether a project should be accepted. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts