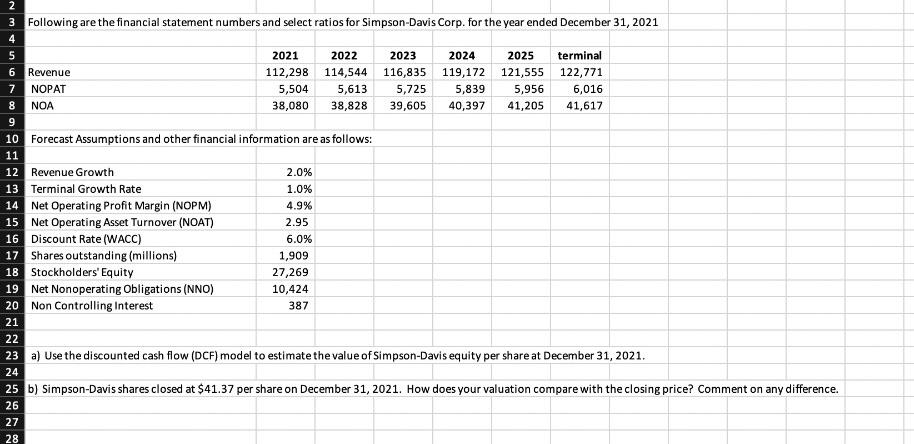

Question: 2 3 Following are the financial statement numbers and select ratios for Simpson-Davis Corp. for the year ended December 31, 2021 4 5 2021

2 3 Following are the financial statement numbers and select ratios for Simpson-Davis Corp. for the year ended December 31, 2021 4 5 2021 2022 6 Revenue 7 NOPAT 8 NOA 112,298 114,544 5,504 5,613 38,080 38,828 2023 116,835 5,725 39,605 2024 2025 terminal 119,172 121,555 122,771 5,839 5,956 6,016 40,397 41,205 41,617 9 10 Forecast Assumptions and other financial information are as follows: 11 12 Revenue Growth 2.0% 13 Terminal Growth Rate 1.0% 14 Net Operating Profit Margin (NOPM) 4.9% 15 Net Operating Asset Turnover (NOAT) 2.95 16 Discount Rate (WACC) 6.0% 17 Shares outstanding (millions) 1,909 18 Stockholders' Equity 27,269 19 Net Nonoperating Obligations (NNO) 10,424 20 Non Controlling Interest 387 21 22 23 a) Use the discounted cash flow (DCF) model to estimate the value of Simpson-Davis equity per share at December 31, 2021. 24 25 b) Simpson-Davis shares closed at $41.37 per share on December 31, 2021. How does your valuation compare with the closing price? Comment on any difference. 26 27 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts