Question: #2 & #3 Planning for College and Beyond 2. What amount would he need to contribute each year to reach his goal? 3. What annual

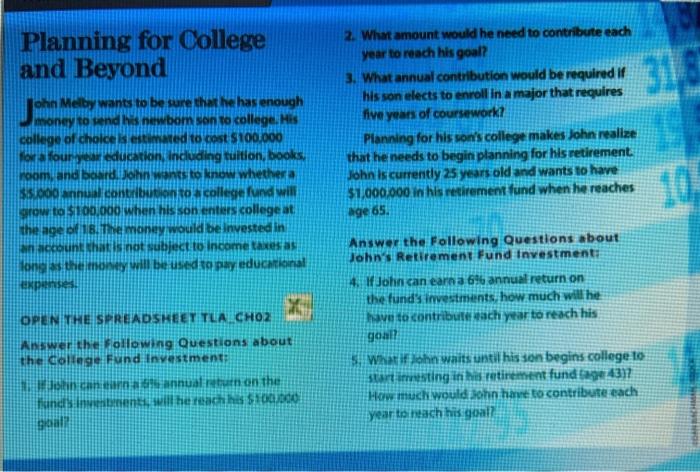

Planning for College and Beyond 2. What amount would he need to contribute each year to reach his goal? 3. What annual contribution would be required if his son elects to enroll in a major that requires five years of coursework? Planning for his son's college makes John realize that he needs to begin planning for his retirement. John is currently 25 years old and wants to have $1,000,000 in his retirement fund when he reaches hn Melby wants to be sure that he has enough money to send his newbom son to college. His college of choice is estimated to cost $100.000 for four year tuition, books, room and board, John wants to know whether SSC anul contribu to a college fund will grow to $100.000 when his son enters college at the age of 18. The money would be invested in an account that is not subject to income taxea long as the mo will be used to pay educational indud age 65. OPEN THE SPREADSHEET TLA CHOZ Answer the following Questions about the college Fund Investment incandan annual return on the ind nu will he reach St. Answer the following Questions about John's Retirement Fund Investment: 4. John can earn a 696 annual return on the funds investments, how much will be wave to contribute ach year to reach his goal? Whaton waits until his son begins college to Startimesting in his retirement fund tage 437 How much would son hand to contribute each year teach his goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts