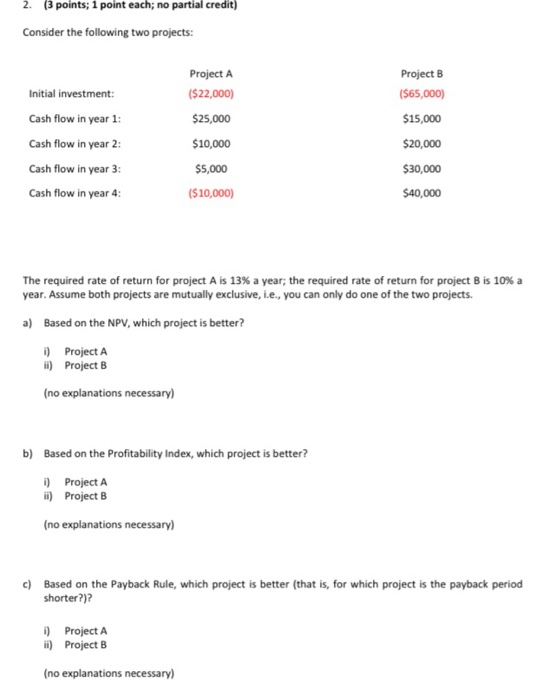

Question: 2. (3 points; 1 point each; no partial credit) Consider the following two projects: Project A ($22,000) Initial investment: Cash flow in year 1: $25,000

2. (3 points; 1 point each; no partial credit) Consider the following two projects: Project A ($22,000) Initial investment: Cash flow in year 1: $25,000 $10,000 Project B ($65,000) $15,000 $20,000 $30,000 $40,000 Cash flow in year 2 Cash flow in year 3: $5,000 Cash flow in year 4: ($10,000) The required rate of return for project A is 13% a year, the required rate of return for project Bis 10% a year. Assume both projects are mutually exclusive, i.e., you can only do one of the two projects. a) Based on the NPV, which project is better? i) ii) Project A Project B (no explanations necessary) b) Based on the Profitability Index, which project is better? i) ii) Project A Project B (no explanations necessary) c) Based on the Payback Rule, which project is better that is, for which project is the payback period shorter?)? i) Project A 1) Project B (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts