Question: 2. (3 points) Amortization Schedule: Application of equal amount payment Opaquex, a local start-up in Buffalo New York approached an investment bank to finance its

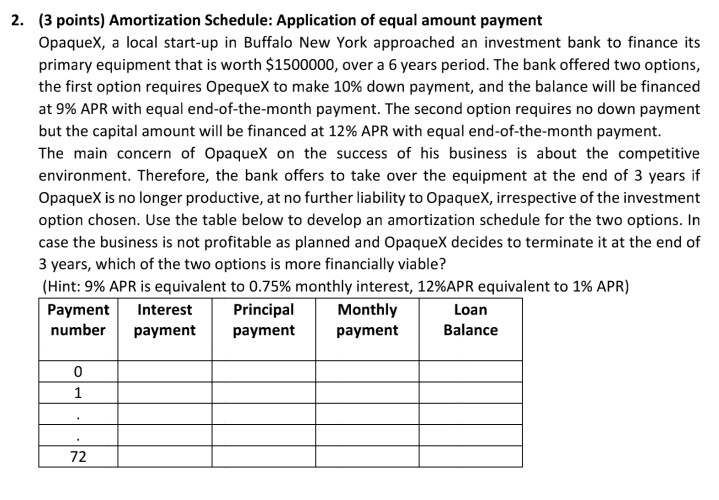

2. (3 points) Amortization Schedule: Application of equal amount payment Opaquex, a local start-up in Buffalo New York approached an investment bank to finance its primary equipment that is worth $1500000, over a 6 years period. The bank offered two options, the first option requires OpequeX to make 10% down payment, and the balance will be financed at 9% APR with equal end-of-the-month payment. The second option requires no down payment but the capital amount will be financed at 12% APR with equal end-of-the-month payment. The main concern of Opaquex on the success of his business is about the competitive environment. Therefore, the bank offers to take over the equipment at the end of 3 years if OpaqueX is no longer productive, at no further liability to OpaqueX, irrespective of the investment option chosen. Use the table below to develop an amortization schedule for the two options. In case the business is not profitable as planned and Opaquex decides to terminate it at the end of 3 years, which of the two options is more financially viable? (Hint: 9% APR is equivalent to 0.75% monthly interest, 12%APR equivalent to 1% APR) Payment Interest Principal Monthly Loan number payment payment payment Balance 0 1 72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts