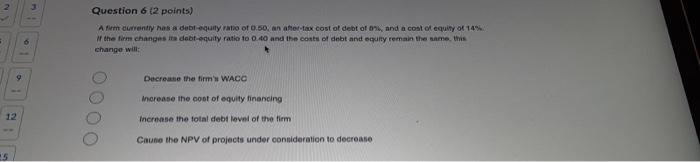

Question: 2 3 Question 6 (2 points) Afirm currently has a debl-equity ratio of 0.50, an after-tax cost of debt of %, and a cost of

2 3 Question 6 (2 points) Afirm currently has a debl-equity ratio of 0.50, an after-tax cost of debt of %, and a cost of equity of 14% If the firm changes its debt-equity ratio to 0.40 and the costs of debt and equity remain the same this change will 9 Decrease the firm' WACO Increase the cost of equity financing 12 Increase the total debt level of the firm Cause the NPV of projects under consideration to decrease 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts