Question: 2. (30 points) This question is going to ask you to create a written response to a more general policy question using the concepts

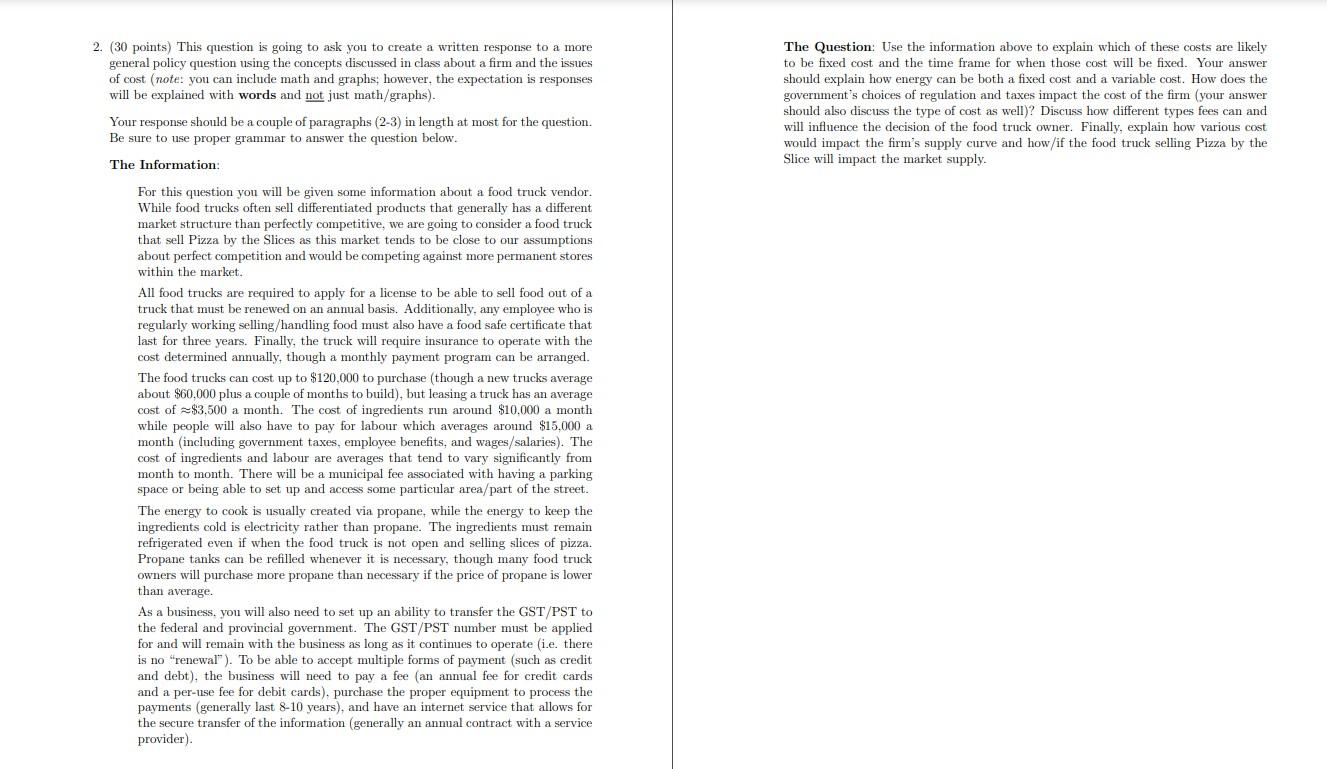

2. (30 points) This question is going to ask you to create a written response to a more general policy question using the concepts discussed in class about a firm and the issues of cost (note: you can include math and graphs; however, the expectation is responses will be explained with words and not just math/graphs).. Your response should be a couple of paragraphs (2-3) in length at most for the question. Be sure to use proper grammar to answer the question below. The Information: For this question you will be given some information about a food truck vendor. While food trucks often sell differentiated products that generally has a different market structure than perfectly competitive, we are going to consider a food truck that sell Pizza by the Slices as this market tends to be close to our assumptions about perfect competition and would be competing against more permanent stores within the market. All food trucks are required to apply for a license to be able to sell food out of a truck that must be renewed on an annual basis. Additionally, any employee who is regularly working selling/handling food must also have a food safe certificate that last for three years. Finally, the truck will require insurance to operate with the cost determined annually, though a monthly payment program can be arranged. The food trucks can cost up to $120,000 to purchase (though a new trucks average about $60,000 plus a couple of months to build), but leasing a truck has an average cost of $3,500 a month. The cost of ingredients run around $10,000 a month while people will also have to pay for labour which averages around $15,000 a month (including government taxes, employee benefits, and wages/salaries). The cost of ingredients and labour are averages that tend to vary significantly from month to month. There will be a municipal fee associated with having a parking space or being able to set up and access some particular area/part of the street. The energy to cook is usually created via propane, while the energy to keep the ingredients cold is electricity rather than propane. The ingredients must remain refrigerated even if when the food truck is not open and selling slices of pizza. Propane tanks can be refilled whenever it is necessary, though many food truck owners will purchase more propane than necessary if the price of propane is lower than average. As a business, you will also need to set up an ability to transfer the GST/PST to the federal and provincial government. The GST/PST number must be applied for and will remain with the business as long as it continues to operate (i.e. there is no "renewal"). To be able to accept multiple forms of payment (such as credit and debt), the business will need to pay a fee (an annual fee for credit cards and a per-use fee for debit cards), purchase the proper equipment to process the payments (generally last 8-10 years), and have an internet service that allows for the secure transfer of the information (generally an annual contract with a service provider). The Question: Use the information above to explain which of these costs are likely to be fixed cost and the time frame for when those cost will be fixed. Your answer should explain how energy can be both a fixed cost and a variable cost. How does the government nt's choices of regulation and taxes impact the cost of the firm (your answer should also discuss the type of cost as well)? Discuss how different types fees can and will influence the decision of the food truck owner. Finally, explain how various cost would impact the firm's supply curve and how/if the food truck selling Pizza by the Slice will impact the market supply.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Fixed costs are those that do not vary with the level of output or sales In the context of the food truck vendor fixed costs include the annual licens... View full answer

Get step-by-step solutions from verified subject matter experts