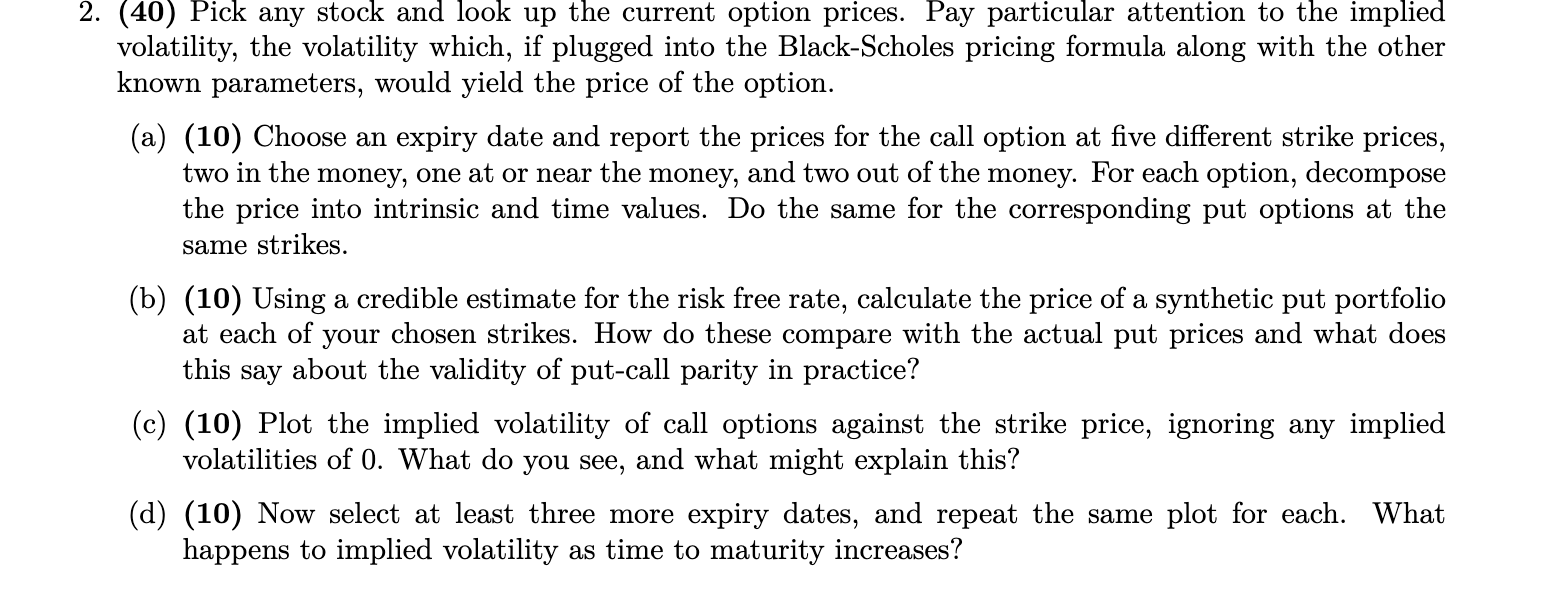

Question: 2 . ( 4 0 ) Pick any stock and look up the current option prices. Pay particular attention to the implied volatility, the volatility

Pick any stock and look up the current option prices. Pay particular attention to the implied volatility, the volatility which, if plugged into the BlackScholes pricing formula along with the other known parameters, would yield the price of the option.

a Choose an expiry date and report the prices for the call option at five different strike prices, two in the money, one at or near the money, and two out of the money. For each option, decompose the price into intrinsic and time values. Do the same for the corresponding put options at the same strikes.

b Using a credible estimate for the risk free rate, calculate the price of a synthetic put portfolio at each of your chosen strikes. How do these compare with the actual put prices and what does this say about the validity of putcall parity in practice?

c Plot the implied volatility of call options against the strike price, ignoring any implied volatilities of What do you see, and what might explain this?

d Now select at least three more expiry dates, and repeat the same plot for each. What happens to implied volatility as time to maturity increases?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock