Question: 2. (40 points) Use the internet find prices data for the following sectors of the S&P index (use daily data starting 2000 to end of

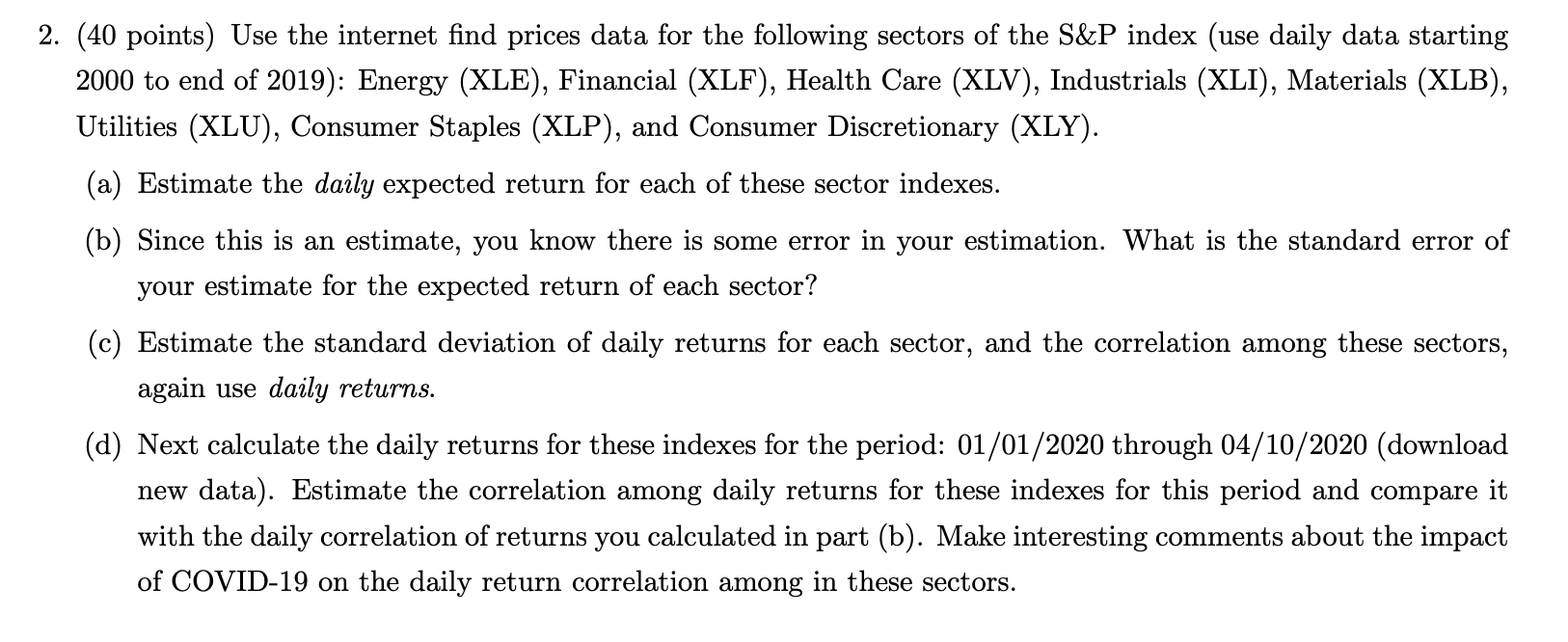

2. (40 points) Use the internet find prices data for the following sectors of the S&P index (use daily data starting 2000 to end of 2019): Energy (XLE), Financial (XLF), Health Care (XLV), Industrials (XLI), Materials (XLB), Utilities (XLU), Consumer Staples (XLP), and Consumer Discretionary (XLY). (a) Estimate the daily expected return for each of these sector indexes. (b) Since this is an estimate, you know there is some error in your estimation. What is the standard error of your estimate for the expected return of each sector? (c) Estimate the standard deviation of daily returns for each sector, and the correlation among these sectors, again use daily returns. (d) Next calculate the daily returns for these indexes for the period: 01/01/2020 through 04/10/2020 (download new data). Estimate the correlation among daily returns for these indexes for this period and compare it with the daily correlation of returns you calculated in part (b). Make interesting comments about the impact of COVID-19 on the daily return correlation among in these sectors. 2. (40 points) Use the internet find prices data for the following sectors of the S&P index (use daily data starting 2000 to end of 2019): Energy (XLE), Financial (XLF), Health Care (XLV), Industrials (XLI), Materials (XLB), Utilities (XLU), Consumer Staples (XLP), and Consumer Discretionary (XLY). (a) Estimate the daily expected return for each of these sector indexes. (b) Since this is an estimate, you know there is some error in your estimation. What is the standard error of your estimate for the expected return of each sector? (c) Estimate the standard deviation of daily returns for each sector, and the correlation among these sectors, again use daily returns. (d) Next calculate the daily returns for these indexes for the period: 01/01/2020 through 04/10/2020 (download new data). Estimate the correlation among daily returns for these indexes for this period and compare it with the daily correlation of returns you calculated in part (b). Make interesting comments about the impact of COVID-19 on the daily return correlation among in these sectors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts