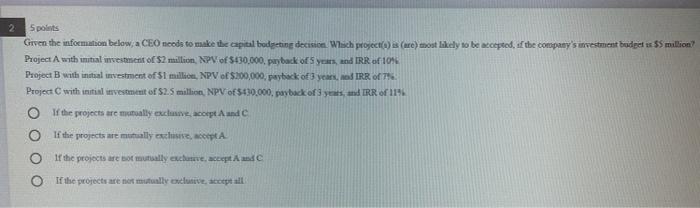

Question: 2 5 points Given the information below, a CEO needs to make the capital badpeting decision Wsch project() (ure) most likely to be accepted the

2 5 points Given the information below, a CEO needs to make the capital badpeting decision Wsch project() (ure) most likely to be accepted the company's restent budgets $5 million Project A with initial investment of $2 million, NPV of $130.000, payback of years, and IRR of 104 Project B with intal investment of $1 million, NPV of $200,000, payback of 3 years, IRR of 7 Project with initial investment of $2.5 million, NPV of $130.000, payback of yes, and IRR of 1146 of the projects are manually exclusive accept Aande of the projects are mually exclusive, accept If the projects are not mually exclusive accept and O If the projects are not mutuelle exclusive, accept all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts