Question: ( 2 5 points ) Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently merged. Their current market sizes are shown in

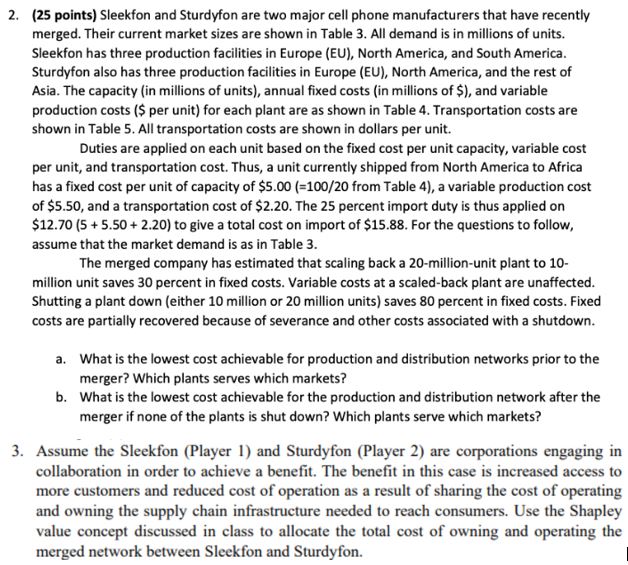

points Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently

merged. Their current market sizes are shown in Table All demand is in millions of units.

Sleekfon has three production facilities in Europe EU North America, and South America.

Sturdyfon also has three production facilities in Europe EU North America, and the rest of

Asia. The capacity in millions of units annual fixed costs in millions of $ and variable

production costs $ per unit for each plant are as shown in Table Transportation costs are

shown in Table All transportation costs are shown in dollars per unit.

Duties are applied on each unit based on the fixed cost per unit capacity, variable cost

per unit, and transportation cost. Thus, a unit currently shipped from North America to Africa

has a fixed cost per unit of capacity of from Table a variable production cost

of $ and a transportation cost of $ The percent import duty is thus applied on

$ to give a total cost on import of $ For the questions to follow,

assume that the market demand is as in Table

The merged company has estimated that scaling back a millionunit plant to

million unit saves percent in fixed costs. Variable costs at a scaledback plant are unaffected.

Shutting a plant down either million or million units saves percent in fixed costs. Fixed

costs are partially recovered because of severance and other costs associated with a shutdown.

a What is the lowest cost achievable for production and distribution networks prior to the

merger? Which plants serves which markets?

b What is the lowest cost achievable for the production and distribution network after the

merger if none of the plants is shut down? Which plants serve which markets?

Assume the Sleekfon Player and Sturdyfon Player are corporations engaging in

collaboration in order to achieve a benefit. The benefit in this case is increased access to

more customers and reduced cost of operation as a result of sharing the cost of operating

and owning the supply chain infrastructure needed to reach consumers. Use the Shapley

value concept discussed in class to allocate the total cost of owning and operating the

merged network between Sleekfon and Sturdyfon.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock