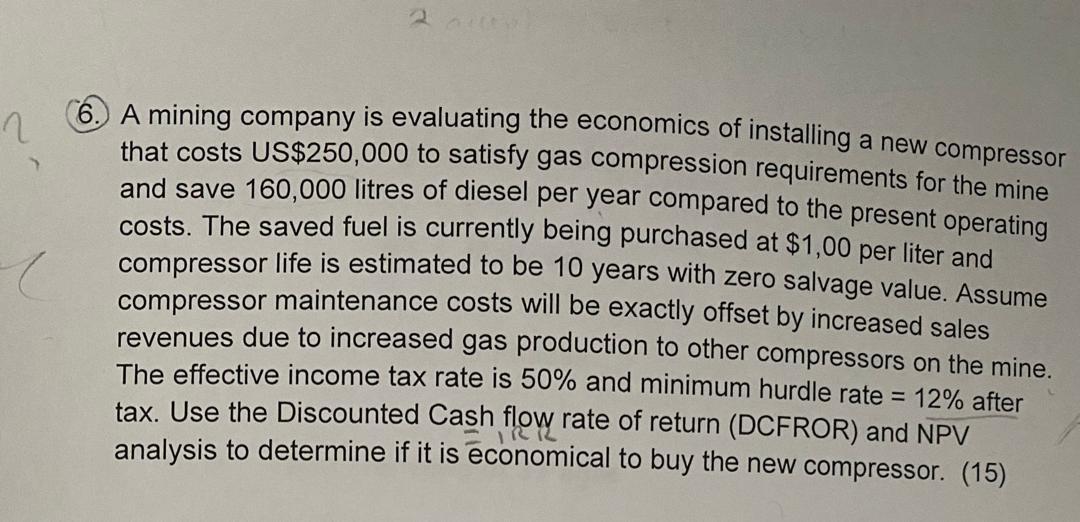

Question: 2 > 6. A mining company is evaluating the economics of installing a new compressor that costs US$250,000 to satisfy gas compression requirements for the

2 > 6. A mining company is evaluating the economics of installing a new compressor that costs US$250,000 to satisfy gas compression requirements for the mine and save 160,000 litres of diesel per year compared to the present operating costs. The saved fuel is currently being purchased at $1,00 per liter and compressor life is estimated to be 10 years with zero salvage value. Assume compressor maintenance costs will be exactly offset by increased sales revenues due to increased gas production to other compressors on the mine. The effective income tax rate is 50% and minimum hurdle rate = 12% after tax. Use the Discounted Cash flow rate of return (DCFROR) and NPV analysis to determine if it is economical to buy the new compressor. (15)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts