Question: 2 6 . A taxpayer performs computer systems consulting services in addition to their regular job. Their regular ( mathrm { W }

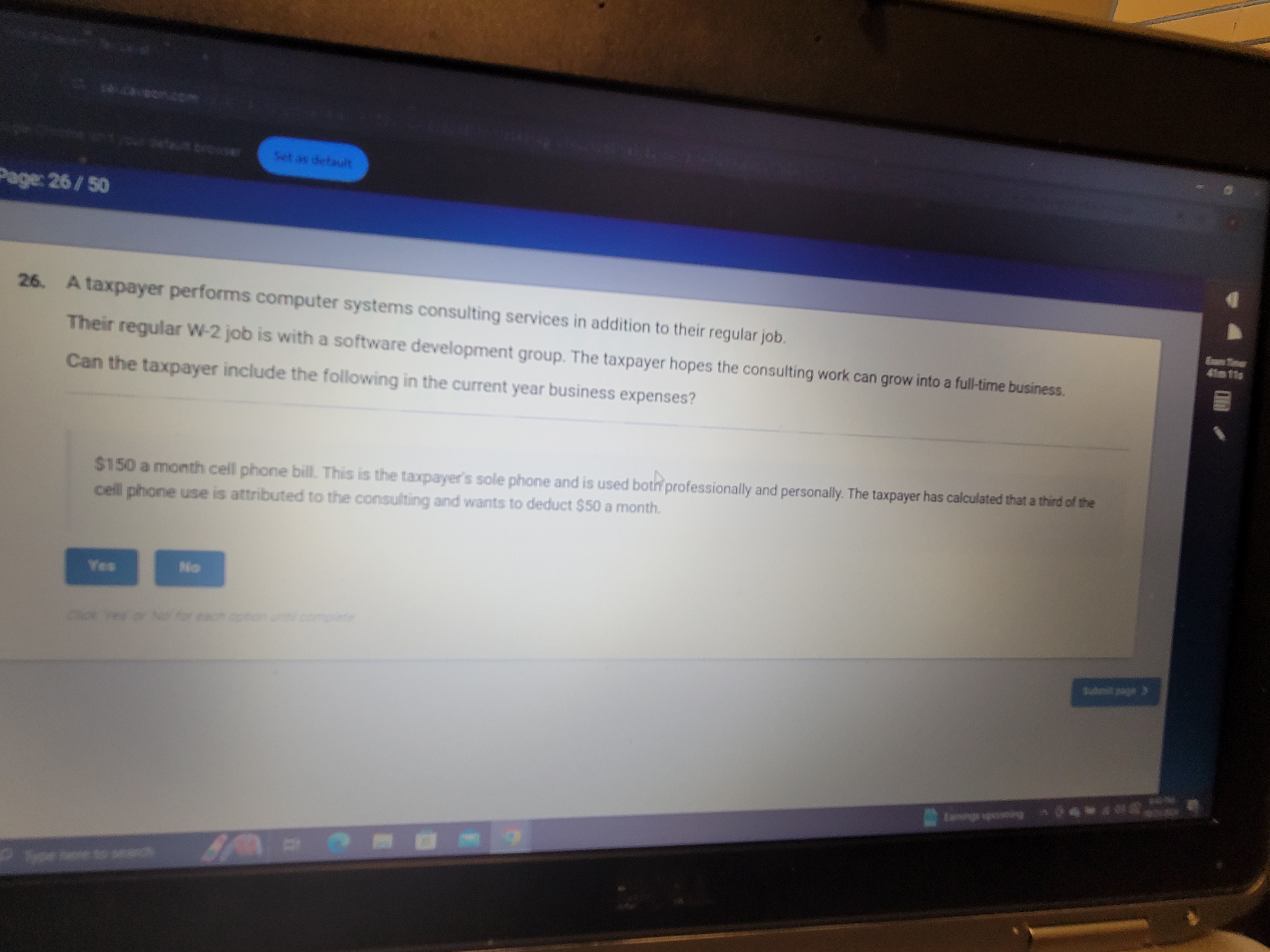

A taxpayer performs computer systems consulting services in addition to their regular job.

Their regular mathrmWmathrmjob is with a software development group. The taxpayer hopes the consulting work can grow into a fulltime business.

Can the taxpayer include the following in the current year business expenses?

$ a month cell phone bill. This is the taxpayer's sole phone and is used both professionally and personally. The taxpayer has calculated that a third of the cell phone use is attributed to the consulting and wants to deduct $ a month.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock