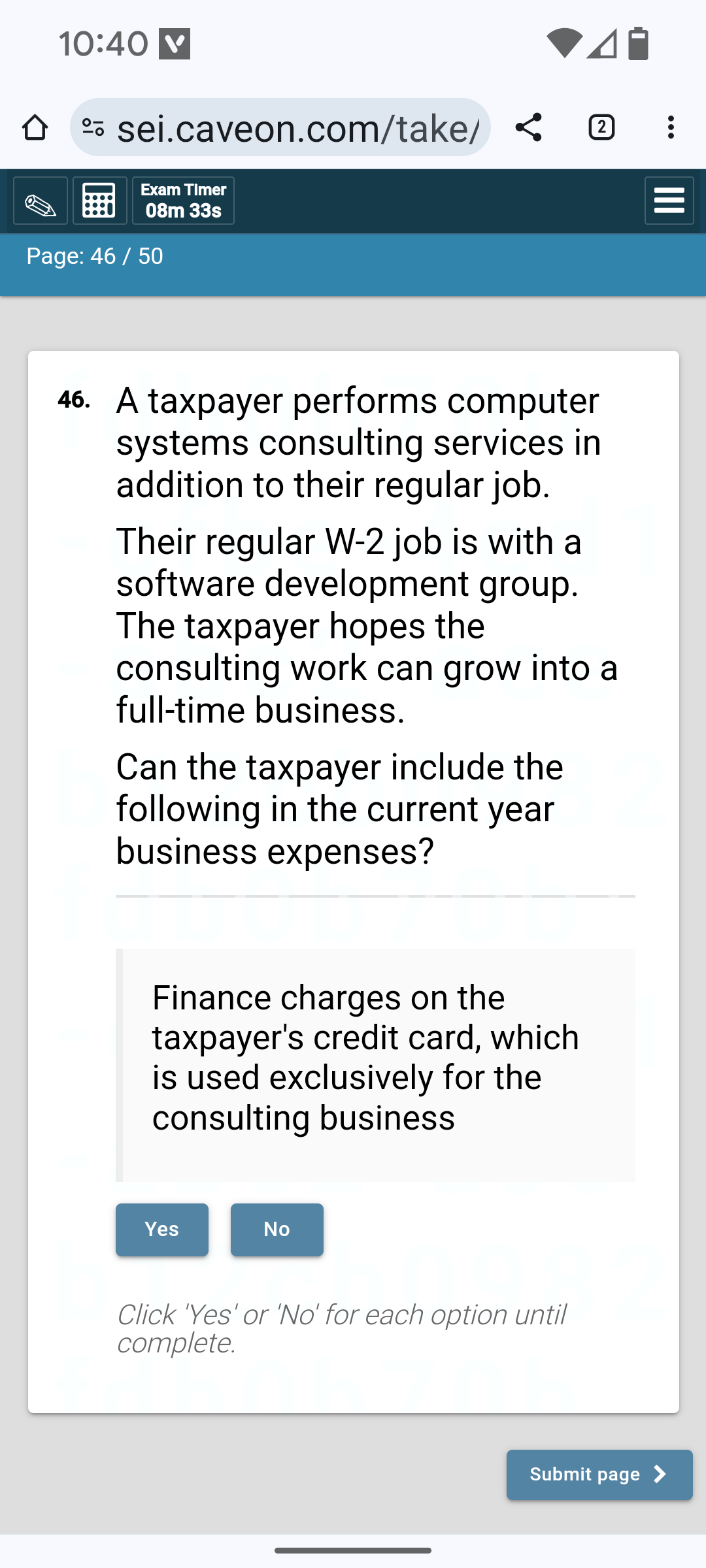

Question: A taxpayer performs computer systems consulting services in addition to their regular job. Their regular W - 2 job is with a software development group.

A taxpayer performs computer

systems consulting services in

addition to their regular job.

Their regular W job is with a

software development group.

The taxpayer hopes the

consulting work can grow into a

fulltime business.

Can the taxpayer include the

following in the current year

business expenses?

Finance charges on the

taxpayer's credit card, which

is used exclusively for the

consulting business

Click 'Yes' or No for each option until

complete.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock