Question: 2 a ) A company's share is expected to pay a dividend of sh . 3 per share next year. An investor wishes to buy

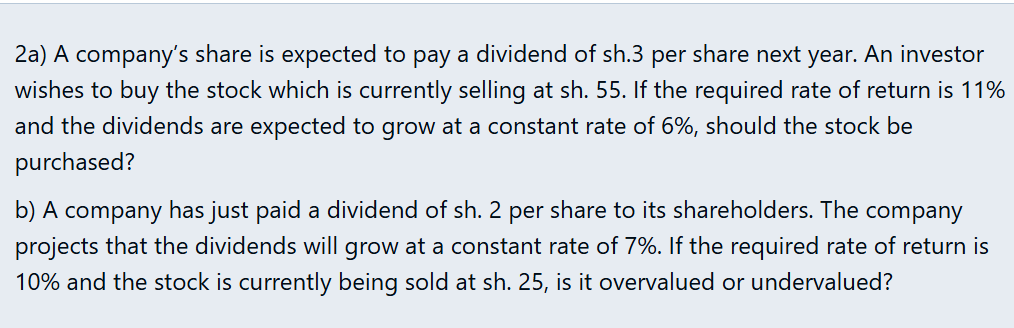

a A company's share is expected to pay a dividend of sh per share next year. An investor wishes to buy the stock which is currently selling at sh If the required rate of return is and the dividends are expected to grow at a constant rate of should the stock be purchased?

b A company has just paid a dividend of sh per share to its shareholders. The company projects that the dividends will grow at a constant rate of If the required rate of return is and the stock is currently being sold at sh is it overvalued or undervalued?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock