Question: 2. a. A semi-annual bond with a face (par) value of $1,000 has an annual coupon rate of 8%. If 23 days have passed since

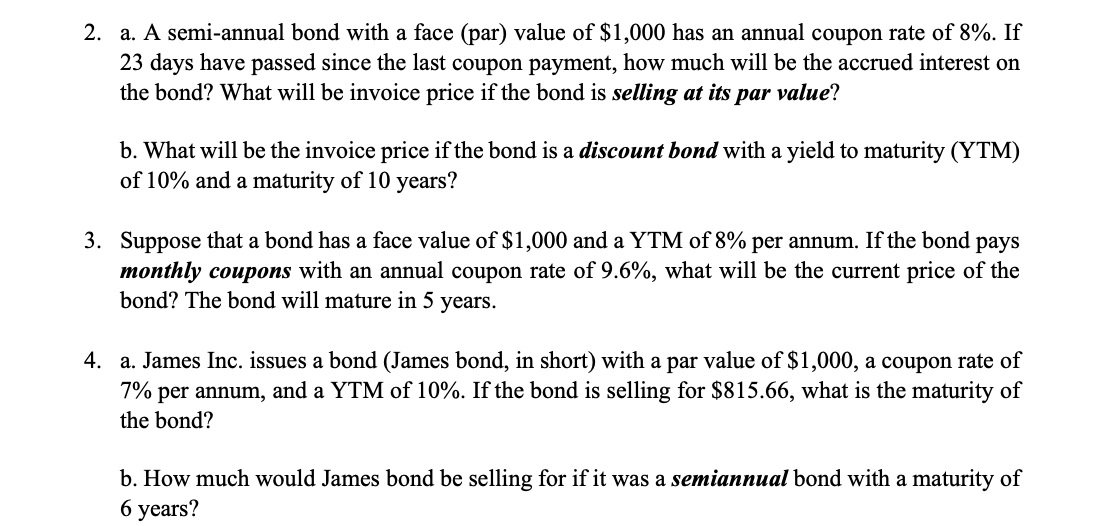

2. a. A semi-annual bond with a face (par) value of $1,000 has an annual coupon rate of 8%. If 23 days have passed since the last coupon payment, how much will be the accrued interest on the bond? What will be invoice price if the bond is selling at its par value? b. What will be the invoice price if the bond is a discount bond with a yield to maturity (YTM) of 10% and a maturity of 10 years? 3. Suppose that a bond has a face value of $1,000 and a YTM of 8% per annum. If the bond pays monthly coupons with an annual coupon rate of 9.6%, what will be the current price of the bond? The bond will mature in 5 years. 4. a. James Inc. issues a bond (James bond, in short) with a par value of $1,000, a coupon rate of 7% per annum, and a YTM of 10%. If the bond is selling for $815.66, what is the maturity of the bond? b. How much would James bond be selling for if it was a semiannual bond with a maturity of 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts