Question: Part A: (35 marks) Instruction: Answer all questions. 1 Den med anem, Fehleh WASS the following questions BioCom, Inc. is weichting a mosal to manufacture

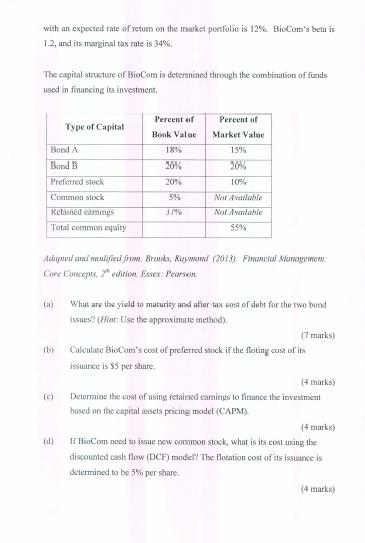

Part A: (35 marks) Instruction: Answer all questions. 1 Den med anem, Fehleh WASS" the following questions BioCom, Inc. is weichting a mosal to manufacture and market a fiber optic device that will continuously monitor biood pressure during cardiovascular surgery and other medical procedures in which precise, real-time measurements are critical. In the course of discussing the fiber optic blood pressure monitor project, a recently hired financial analyst, who is working on her MBA, asks how the company arrived at us the discount rate to use when evaluating capital hudgeting projects Her question is followed by an embarrassing silence than seems to last forever. Eventually, the comptroller, who has been with the company for many years, offers an explanation. In the 1980s, the company used 119% as its dascount mate as what has been implemented by its consultant. By the late 1990s, interest rate had fallen considerably and the company was rejecting some seemingly profitable projects Le lende was tuulille , le lyweru 9 now. Interestingly many participants in the discussion are aware of the weighted average cost of capital but none had ever attempted to do so for BioCom. After a brief discussion, they ask the person who raised the question in the first place to analyze the company's debt and equity and report back in a week with her estimate of the company's weighted average cost of capital. In her process of gathering the information, it is noted that Broom has two outstanding hond issues. Bond A matures in 6 years, has a par value of S1 000 with an annual coupon rate of 7%, and now sells for $1031. Bond B matures in 16 years, has a par value of St ouo with att ammual coupon rate of 8%, and now sells for $1035. The preferred stock has a par value of $5), pays a dividend of 31.50, and has a current market value of $19. The common stock seils for $35 per share and recently paid a dividend of $2.50. BioCom expects dividends to grow at an average annual rate of 6% for the foreseeable future. The risk-free rate is 3% with an expected rate of retum on the market portfoto is 12%. BioCom's betu is 1.2, and its marginal tax rate is 34%. The capital structure of BioCom is determined through the combination of funds used in financing its investment Type of Capital Percent of Book Value 18% 20% Bond A Bund Preferred stock Percent of Market Value 15% 30% 10% Nor Available Nor Averable 55% 20% 5% Common stock Kened dimings Totalcommon equity Makeland lifed fum. Brauks, Rumum (2013). Final geen Core Concepts, 7 edition Esser: Pearson (a) ib) (c) What are the yield te maturity and after tax cost of debt for the two bond issues? (Hint: Use the approximate method) 17 marks) Calculate BioCom's cost of preferred stock if the feating cost of its issuunce is ss per share (4 marks) Determine the cost of using retained camins to finance the investment based on the capital assets pricing model (CAPM) (4 marks) 1 BioCom need to issue new common stock, what is its cost using the discounted cash flow (DCF) model? The flotation cost of its issuance is determined to be 5% per share (4 marks) id) (e) Calculate the cost of capital of BioCom's capital if it decided to use a combination of external and internal funds. (3 marks) ) (0) What is the cost of capital if only external funds are used in funding BioCom's new investment? (3 marks) (a) Some of BioCom's projects are low risk, while some are average risk or high risk. What action should BioCom exercise in evaluating these projects? (2 marks) 2. Merger or takeover encompasses several types of transactions that vary by the relations between target and the acquirer. Using appropriate examples in Malaysia, at time type leavers. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts