Question: 2. (a) (b) A 5-year bond with a face value of 1000 has a coupon rate of 9%. The yield to maturity on this bond

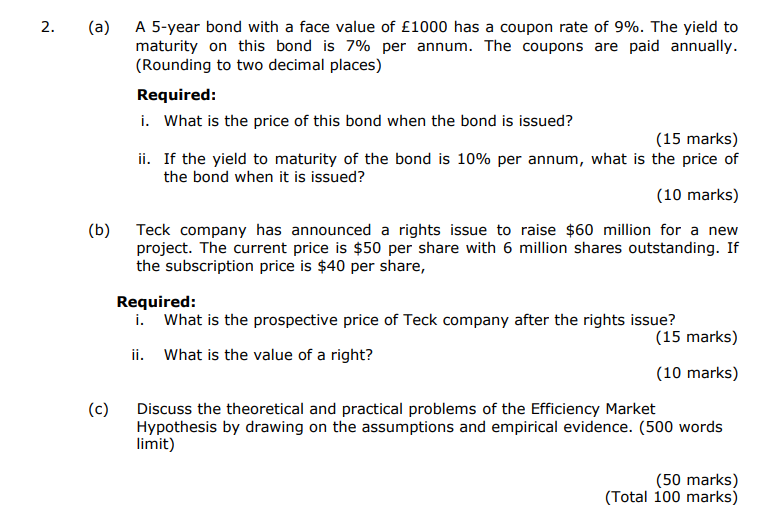

2. (a) (b) A 5-year bond with a face value of 1000 has a coupon rate of 9%. The yield to maturity on this bond is 7% per annum. The coupons are paid annually. (Rounding to two decimal places) Required: i. What is the price of this bond when the bond is issued? (15 marks) ii. If the yield to maturity of the bond is 10% per annum, what is the price of the bond when it is issued? (10 marks) Teck company has announced a rights issue to raise $60 million for a new project. The current price is $50 per share with 6 million shares outstanding. If the subscription price is $40 per share, Required: i. What is the prospective price of Teck company after the rights issue? (15 marks) ii. What is the value of a right? (10 marks) Discuss the theoretical and practical problems of the Efficiency Market Hypothesis by drawing on the assumptions and empirical evidence. (500 words limit) (C) (50 marks) (Total 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts