Question: please show how to solve with simple steps in msft excl 1. 2. 3. 4. If a bond with a face value of $1,000 and

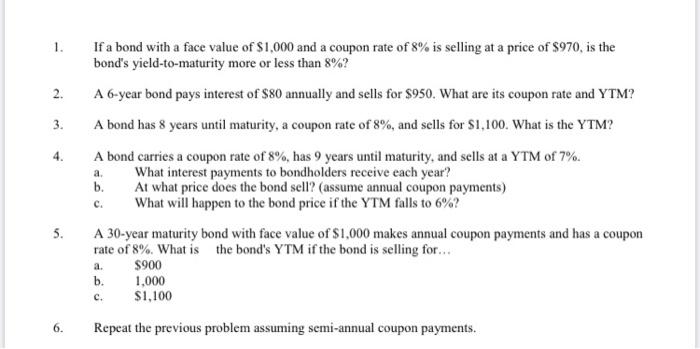

1. 2. 3. 4. If a bond with a face value of $1,000 and a coupon rate of 8% is selling at a price of $970, is the bond's yield-to-maturity more or less than 8%? A 6-year bond pays interest of $80 annually and sells for $950. What are its coupon rate and YTM? A bond has 8 years until maturity, a coupon rate of 8%, and sells for $1,100. What is the YTM? A bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a YTM of 7%. What interest payments to bondholders receive each year? b. At what price does the bond sell? (assume annual coupon payments) What will happen to the bond price if the YTM falls to 6%? A 30-year maturity bond with face value of $1,000 makes annual coupon payments and has a coupon rate of 8%. What is the bond's YTM if the bond is selling for... $900 b. 1,000 $1,100 c. 5. c. 6. Repeat the previous problem assuming semi-annual coupon payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts