Question: 2. a. b. C. d If a bond with an 13.2% coupon rate on a $1,000 par value is currently selling for $840, the bondholder

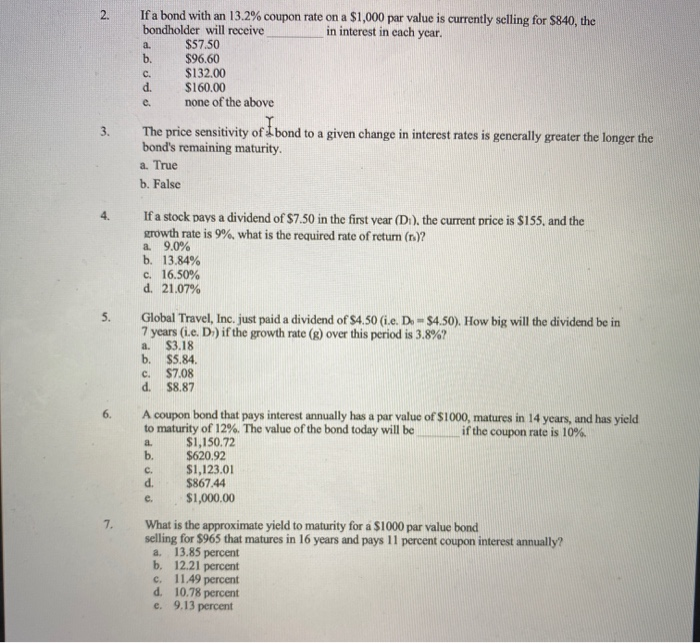

2. a. b. C. d If a bond with an 13.2% coupon rate on a $1,000 par value is currently selling for $840, the bondholder will receive in interest in each year. $57.50 $96.60 $132.00 $160.00 none of the above The price sensitivity of Ibond to a given change in interest rates is generally greater the longer the bond's remaining maturity. a. True b. False e. 3. 4. If a stock pays a dividend of $7.50 in the first year (D1), the current price is $155. and the sztowth rate is 9%, what is the required rate of return (r.)? a. 9.0% b. 13.84% c. 16.50% d. 21.07% Global Travel, Inc. just paid a dividend of $4.50 (1.e. Do = $4.50). How big will the dividend be in 7 years (1.e. Du) if the growth rate (g) over this period is 3.8%? $3.18 $5.84 $7.08 58.87 5. a. b. c. d. 6. a A coupon bond that pays interest annually has a par value of $1000, matures in 14 years, and has yield to maturity of 12%. The value of the bond today will be if the coupon rate is 10% $1,150.72 b. $620.92 $1,123.01 d. $867.44 e. $1,000.00 7. What is the approximate yield to maturity for a $1000 par value bond selling for $965 that matures in 16 years and pays 11 percent coupon interest annually? a. 13.85 percent b. 12.21 percent c. 11.49 percent d. 10.78 percent e. 9.13 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts