Question: 2) A banking analyst is interesied in developing the relationship between the prime lending rate and the federal funds rate, using the federal funds rate

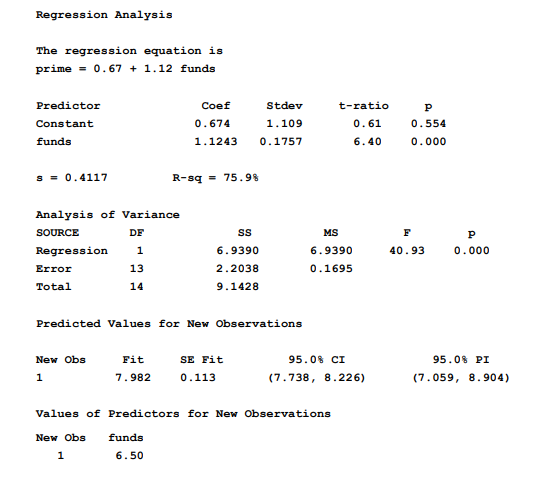

2) A banking analyst is interesied in developing the relationship between the prime lending rate and the federal funds rate, using the federal funds rate (X)) to predict the prime rate (Y). A random sample of 15 weekly observations on both variables is obtained. The MINITAB output 15 below, Regression Analysis The regression equation is prime = 0. 67 + 1.12 funds Predictor Coef Stdev t-ratio P Constant 0.674 1. 109 0 . 61 0 . 554 funds 1 . 1243 0. 1757 6.40 0. 000 3 = 0.4117 R-8q = 75.96 Analysis of Variance SOURCE DF MS E P Regression 1 6.9390 6.9390 40 .93 0. 000 Error 13 2. 2038 0. 1695 Total 14 9. 1428 Predicted Values for New Observations New Obs Fit SE Fit 95. 0% CI 95. 06 PI 1 7. 982 0 . 113 (7.738, 8.226) (7 . 059, 8. 904) Values of Predictors for New Observations New Obs funds 1 6.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts