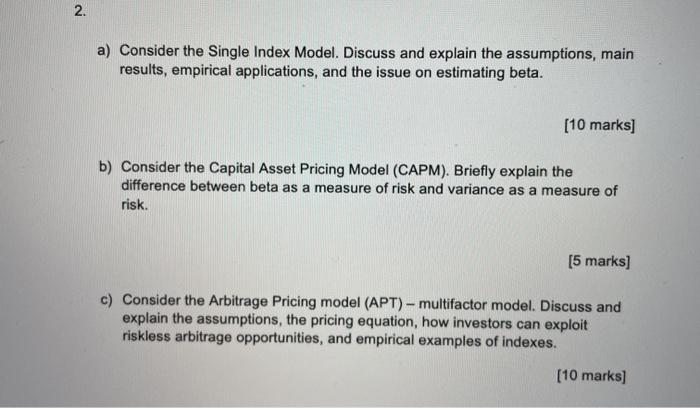

Question: 2. a) Consider the Single Index Model. Discuss and explain the assumptions, main results, empirical applications, and the issue on estimating beta. (10 marks] b)

2. a) Consider the Single Index Model. Discuss and explain the assumptions, main results, empirical applications, and the issue on estimating beta. (10 marks] b) Consider the Capital Asset Pricing Model (CAPM). Briefly explain the difference between beta as a measure of risk and variance as a measure of risk. [5 marks) c) Consider the Arbitrage Pricing model (APT) - multifactor model. Discuss and explain the assumptions, the pricing equation, how investors can exploit riskless arbitrage opportunities, and empirical examples of indexes. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts