Question: 2 a. Create Income Statement b. Create Balance Sheet Complete the ratio analysis a. How has the firms liquidity changed from 2018 to 2019? i.

2 a. Create Income Statement

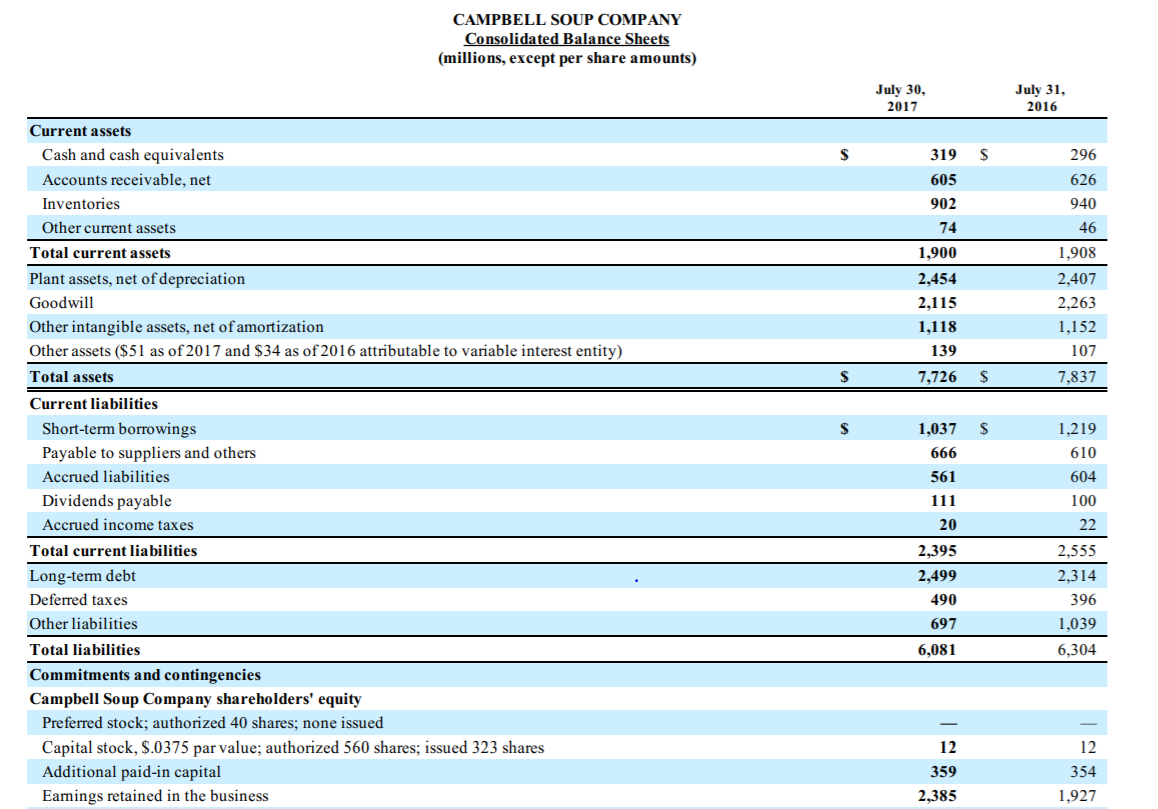

b. Create Balance Sheet

Complete the ratio analysis

a. How has the firms liquidity changed from 2018 to 2019?

i. Compute the current ratio, quick ratio, cash ratio and net working capital ratio

b. How has the firms long-term solvency changed from 2018 to 2019?

i. Compute the debt ratio, the debt-equity ratio, the equity multiplier and the longterm debt ratio

c. How has the firms ability to meet interest payments changed from 2018 to 2019?

i. Compute the times-interest earned & cash coverage ratio

d. How has the firms asset management ratios changed from 2018 to 2019?

i. Compute the inventory turnover & days sales in inventory // How would you interpret these ratios?

ii. Compute the receivables turnover & days sales outstanding // How would you interpret these ratios?

iii. What is the firms total asset turnover and fixed asset turnover?

e. How has the firms profitability changed from 2018 to 2019?

i. Compute the profit margin, return on assets and return on equity

f. How has the firms market value changed from 2018 to 2019?

i. Compute the PE ratio, the market to book ratio and the EBITDA ratios

Using Dupont analysis, show how the firms ROE has changed from 2018 to 2019. What are the significant changes that most impacted the change in the firms ROE?

Please help :( thank you in advance

CAMPBELL SOUP COMPANY Consolidated Balance Sheets (millions, except per share amounts) July 30, 2017 July 31, 2016 $ 296 626 940 46 1,908 319 605 902 - 74 1,900 2,454 2,115 1,118 139 7,726 2,407 2,263 1,152 107 7.837 $ $ $ Current assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total current assets Plant assets, net of depreciation Goodwill Other intangible assets, net of amortization Other assets ($51 as of 2017 and $34 as of 2016 attributable to variable interest entity) Total assets Current liabilities Short-term borrowings Payable to suppliers and others Accrued liabilities Dividends payable Accrued income taxes Total current liabilities Long-term debt Deferred taxes Other liabilities Total liabilities Commitments and contingencies Campbell Soup Company shareholders' equity Preferred stock; authorized 40 shares; none issued Capital stock, $.0375 par value; authorized 560 shares; issued 323 shares Additional paid-in capital Eamings retained in the business 1,037 666 561 111 20 1,219 610 604 100 22 2,555 2,314 396 1,039 6,304 2,395 2,499 490 697 6,081 12 359 12 354 1.927 2,385 1,637 Total Campbell Soup Company shareholders' equity Noncontrolling interests Total equity Total liabilities and equity 1,525 8 1,533 7,837 1,645 7,726 $ $ See accompanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts