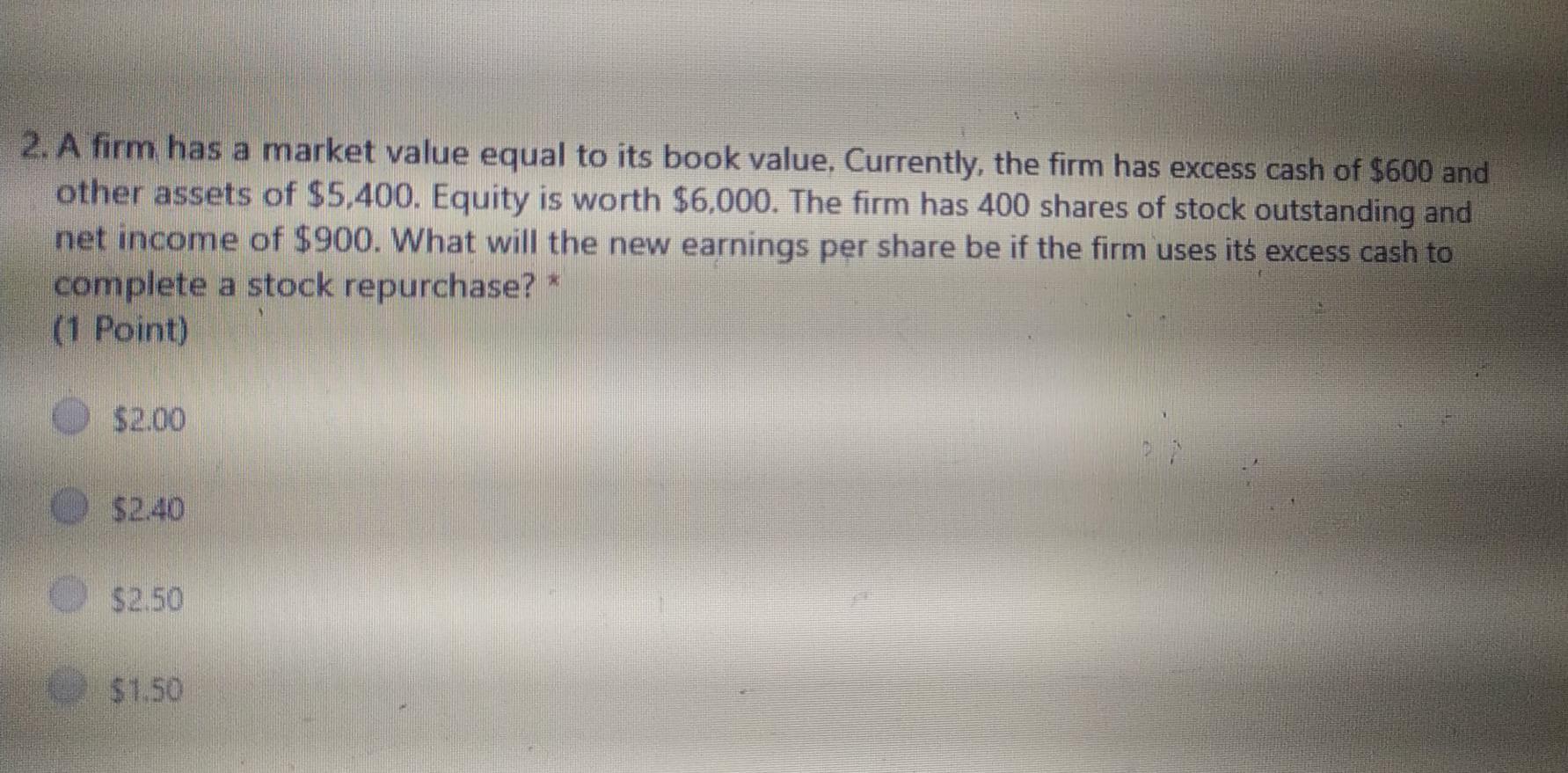

Question: 2. A firm has a market value equal to its book value. Currently, the firm has excess cash of $600 and other assets of $5,400.

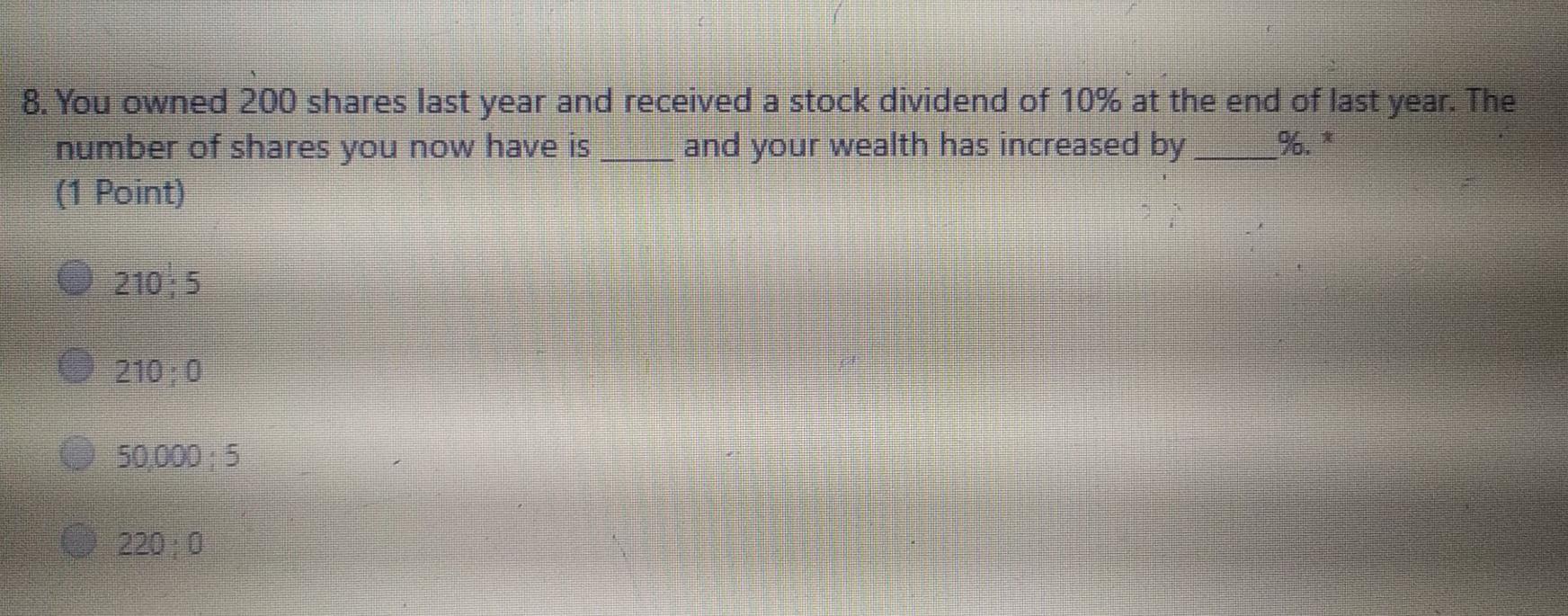

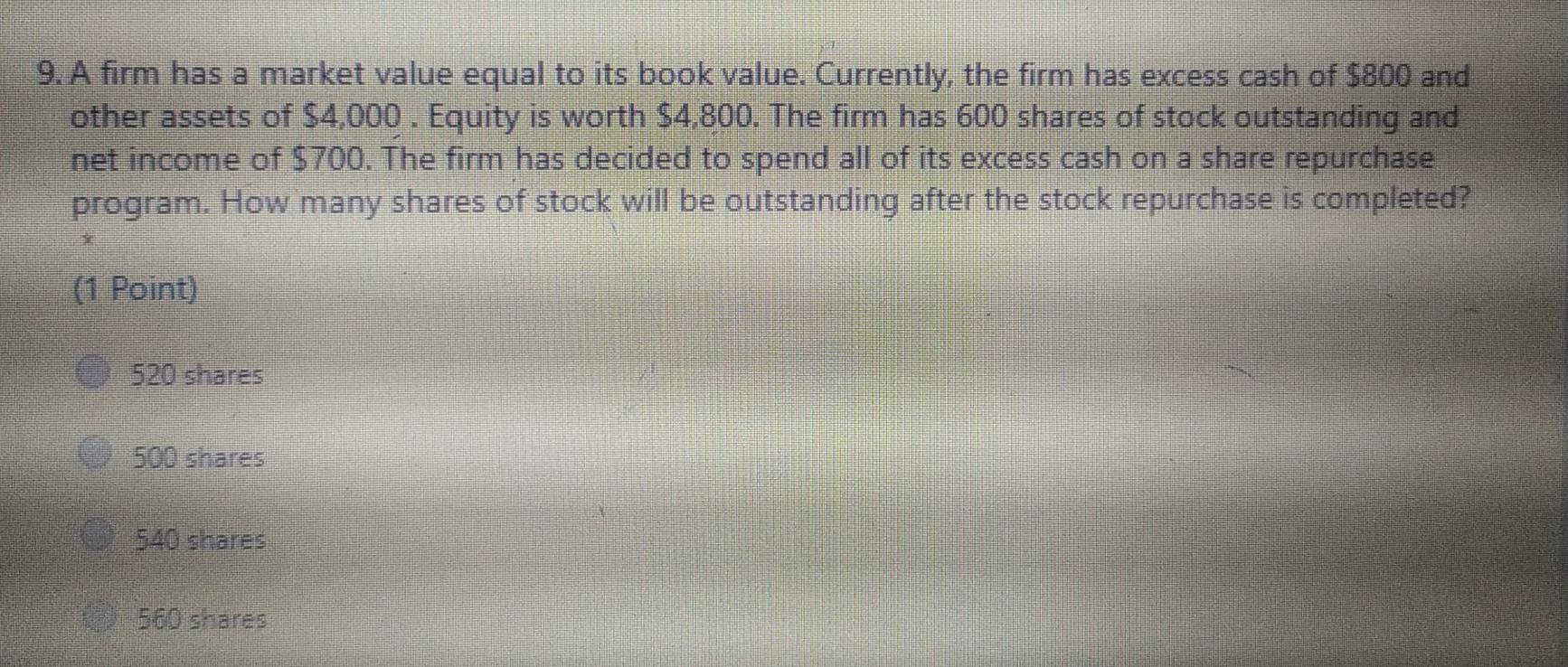

2. A firm has a market value equal to its book value. Currently, the firm has excess cash of $600 and other assets of $5,400. Equity is worth $6,000. The firm has 400 shares of stock outstanding and net income of $900. What will the new earnings per share be if the firm uses its excess cash to complete a stock repurchase? * (1 Point) $2.00 $2.50 8. You owned 200 shares last year and received a stock dividend of 10% at the end of last year. The number of shares you now have is and your wealth has increased by (1 Point) 210:5 210:0 50 000:5 220:0 9. A firm has a market value equal to its book value. Currently, the firm has excess cash of $800 and other assets of $4,000. Equity is worth $4,800. The firm has 600 shares of stock outstanding and net income of $700. The firm has decided to spend all of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? (1 Point) 520 shares 540 shares 500 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts