Question: Excel function please 2. A firm has a market value equal to its book value. Currently, the firm has excess cash of $400 and other

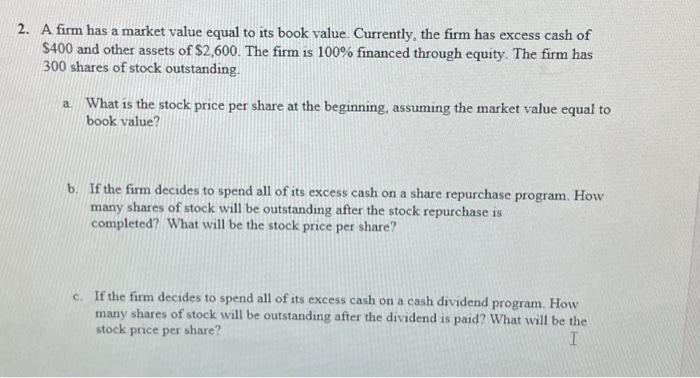

2. A firm has a market value equal to its book value. Currently, the firm has excess cash of $400 and other assets of $2,600. The firm is 100% financed through equity. The firm has 300 shares of stock outstanding. a. What is the stock price per share at the beginning, assuming the market value equal to book value? b. If the firm decides to spend all of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? What will be the stock price per share? c. If the firm decides to spend all of its excess cash on a cash dividend program. How many shares of stock will be outstanding after the dividend is paid? What will be the stock price per share? 2. A firm has a market value equal to its book value. Currently, the firm has excess cash of $400 and other assets of $2,600. The firm is 100% financed through equity. The firm has 300 shares of stock outstanding. a. What is the stock price per share at the beginning, assuming the market value equal to book value? b. If the firm decides to spend all of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? What will be the stock price per share? c. If the firm decides to spend all of its excess cash on a cash dividend program. How many shares of stock will be outstanding after the dividend is paid? What will be the stock price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts