Question: 2. A) Formulate mathematically factor duration, clearly defining the terms you use. B) Using the continuous time pricing formula and the chain rule of

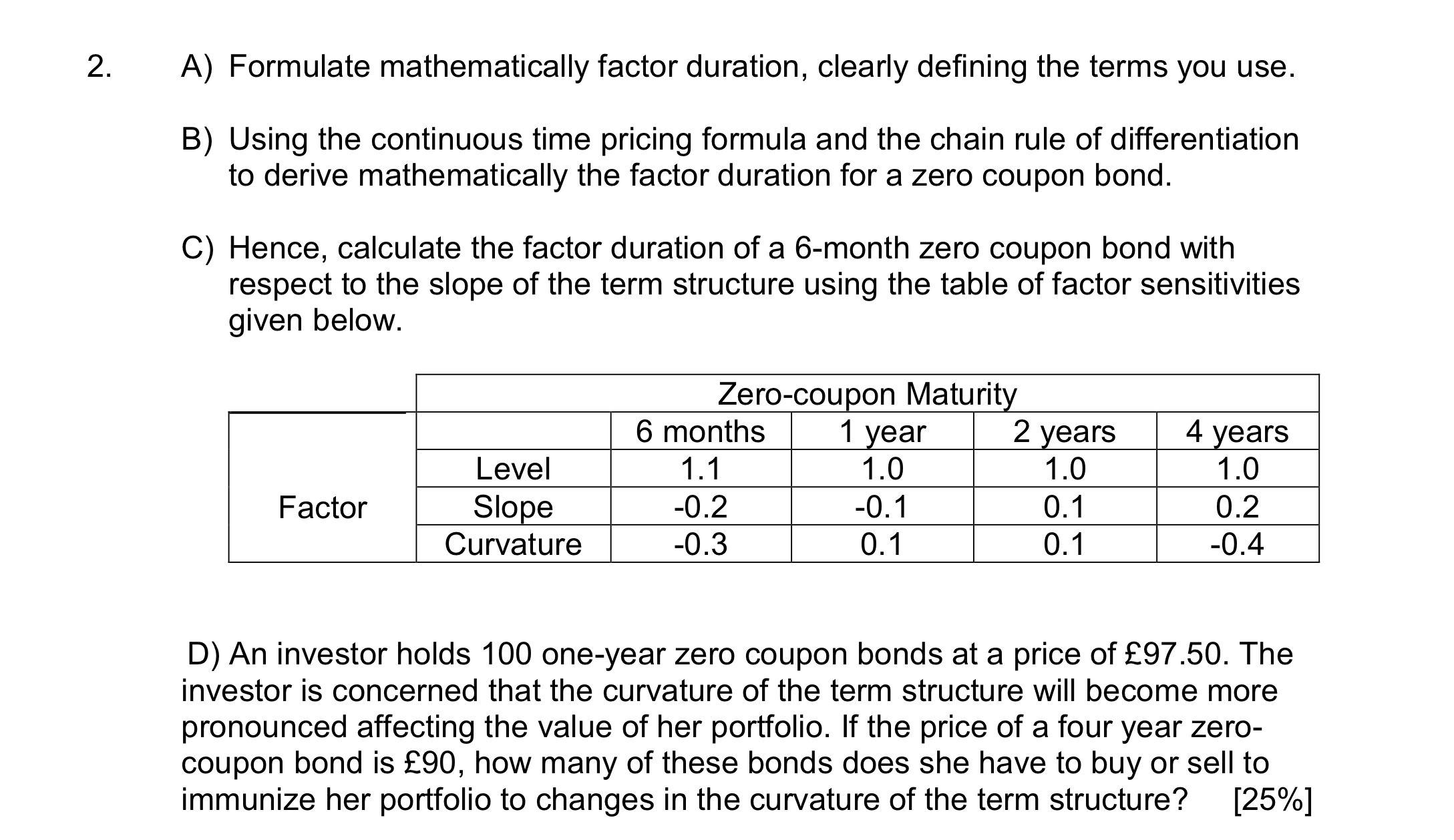

2. A) Formulate mathematically factor duration, clearly defining the terms you use. B) Using the continuous time pricing formula and the chain rule of differentiation to derive mathematically the factor duration for a zero coupon bond. C) Hence, calculate the factor duration of a 6-month zero coupon bond with respect to the slope of the term structure using the table of factor sensitivities given below. Zero-coupon Maturity 6 months 1 year 2 years 4 years Factor Level Slope Curvature 1.1 1.0 1.0 1.0 -0.2 -0.1 0.1 0.2 -0.3 0.1 0.1 -0.4 D) An investor holds 100 one-year zero coupon bonds at a price of 97.50. The investor is concerned that the curvature of the term structure will become more pronounced affecting the value of her portfolio. If the price of a four year zero- coupon bond is 90, how many of these bonds does she have to buy or sell to immunize her portfolio to changes in the curvature of the term structure? [25%]

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

A Formulation of Factor Duration Factor duration measures the sensitivity of the price of a bond to changes in the level slope and curvature of the yield curve Lets define the terms used Level Represe... View full answer

Get step-by-step solutions from verified subject matter experts