Question: 2. (a) From the given information, find out the value per share of PQR Ltd, a small non listed business, under following methods: (i) Net

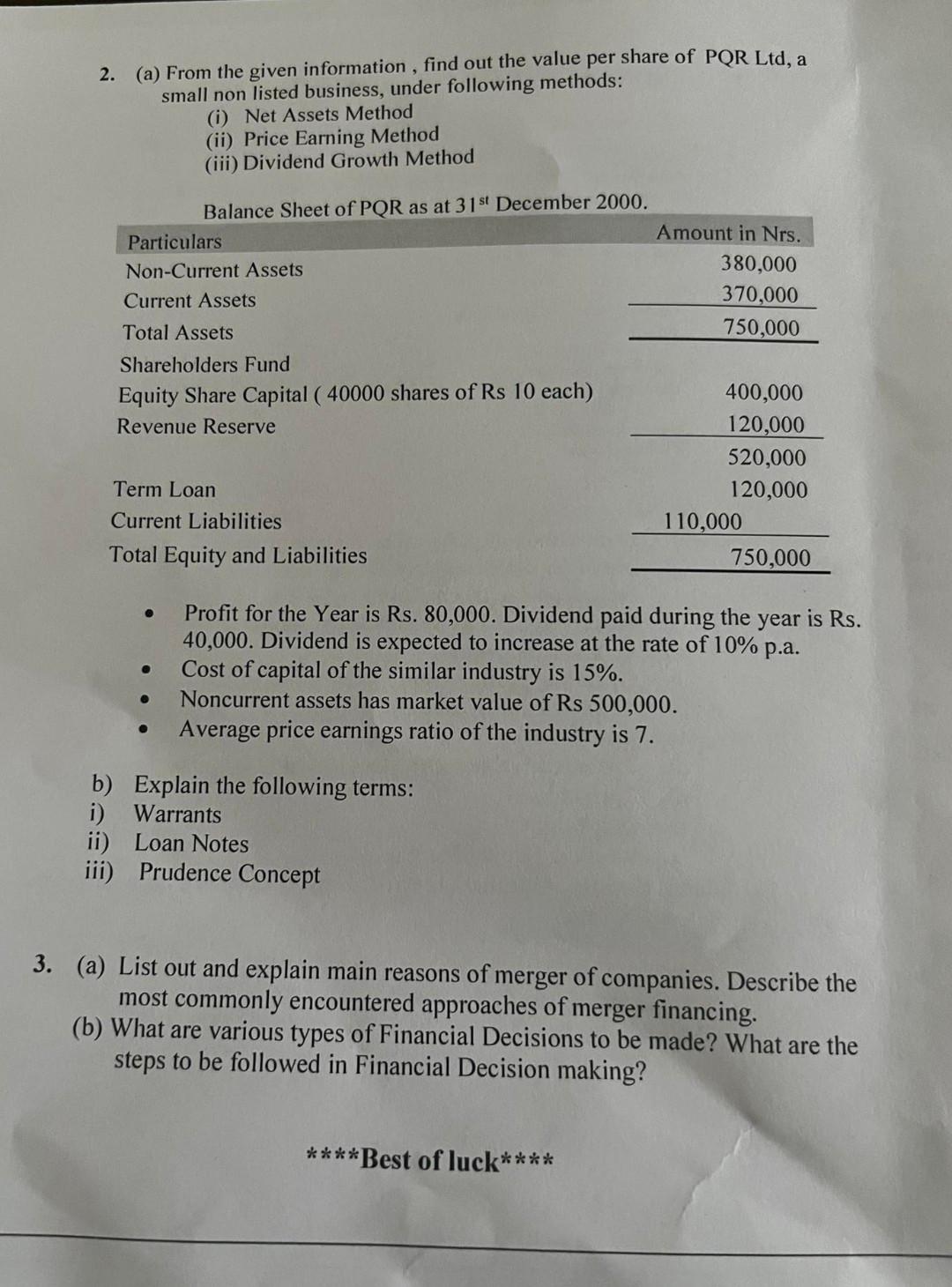

2. (a) From the given information, find out the value per share of PQR Ltd, a small non listed business, under following methods: (i) Net Assets Method (ii) Price Earning Method (iii) Dividend Growth Method Ralance Sheet of POR as at 31st December 2000. - Profit for the Year is Rs. 80,000. Dividend paid during the year is Rs. 40,000 . Dividend is expected to increase at the rate of 10% p.a. - Cost of capital of the similar industry is 15%. - Noncurrent assets has market value of Rs 500,000. - Average price earnings ratio of the industry is 7 . b) Explain the following terms: i) Warrants ii) Loan Notes iii) Prudence Concept 3. (a) List out and explain main reasons of merger of companies. Describe the most commonly encountered approaches of merger financing. (b) What are various types of Financial Decisions to be made? What are the steps to be followed in Financial Decision making? 2. (a) From the given information, find out the value per share of PQR Ltd, a small non listed business, under following methods: (i) Net Assets Method (ii) Price Earning Method (iii) Dividend Growth Method Ralance Sheet of POR as at 31st December 2000. - Profit for the Year is Rs. 80,000. Dividend paid during the year is Rs. 40,000 . Dividend is expected to increase at the rate of 10% p.a. - Cost of capital of the similar industry is 15%. - Noncurrent assets has market value of Rs 500,000. - Average price earnings ratio of the industry is 7 . b) Explain the following terms: i) Warrants ii) Loan Notes iii) Prudence Concept 3. (a) List out and explain main reasons of merger of companies. Describe the most commonly encountered approaches of merger financing. (b) What are various types of Financial Decisions to be made? What are the steps to be followed in Financial Decision making

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts