Question: I need help with this finance question, I need help figuring out how to have a delta neutral portfolio by seeing how much of the

I need help with this finance question, I need help figuring out how to have a delta neutral portfolio by seeing how much of the stock you should sell or buy

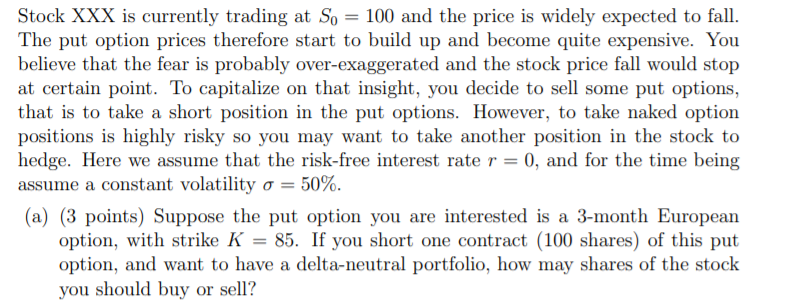

Stock XXX is currently trading at So = 100 and the price is widely expected to fall. The put option prices therefore start to build up and become quite expensive. You believe that the fear is probably over-exaggerated and the stock price fall would stop at certain point. To capitalize on that insight, you decide to sell some put options, that is to take a short position in the put options. However, to take naked option positions is highly risky so you may want to take another position in the stock to hedge. Here we assume that the risk-free interest rate r = 0, and for the time being assume a constant volatility o = 50%. (a) (3 points) Suppose the put option you are interested is a 3-month European option, with strike K = 85. If you short one contract (100 shares) of this put option, and want to have a delta-neutral portfolio, how may shares of the stock you should buy or sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts