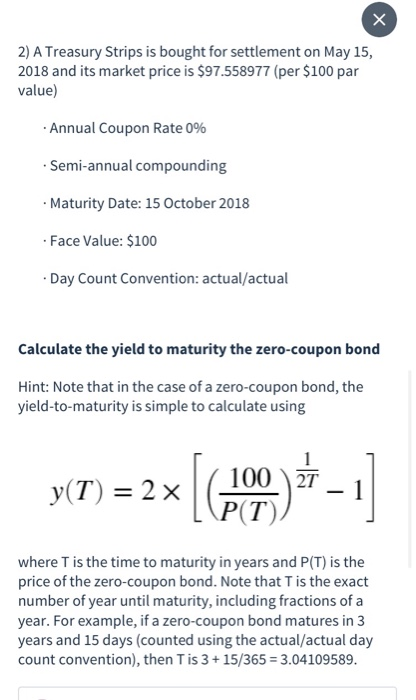

Question: 2) A Treasury Strips is bought for settlement on May 15, 2018 and its market price is $97.558977 (per $100 par value) Annual Coupon Rate

2) A Treasury Strips is bought for settlement on May 15, 2018 and its market price is $97.558977 (per $100 par value) Annual Coupon Rate 0% Semi-annual compounding Maturity Date: 15 October 2018 Face Value: $100 Day Count Convention: actual/actual Calculate the yield to maturity the zero-coupon bond Hint: Note that in the case of a zero-coupon bond, the yield-to-maturity is simple to calculate using y(t) = 2 x [(100-1] U where T is the time to maturity in years and P(T) is the price of the zero-coupon bond. Note that Tis the exact number of year until maturity, including fractions of a year. For example, if a zero-coupon bond matures in 3 years and 15 days (counted using the actual/actual day count convention), then Tis 3 + 15/365 = 3.04109589. 1.1 Unanswered Calculate the number of days until maturity Type your response Submit 1.2 Unanswered Calculate the fraction of a year until maturity. Use 366 as the number of days (i.e. divide the number from the previous question by 366). Round your answer to six digits after the decimal. Type your response Submit 1.3 Unanswered Calculate the yield to maturity of the Treasury Strips. Round your answer to four digits after the decimal point (e.g. 0.1234) Type your response Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts