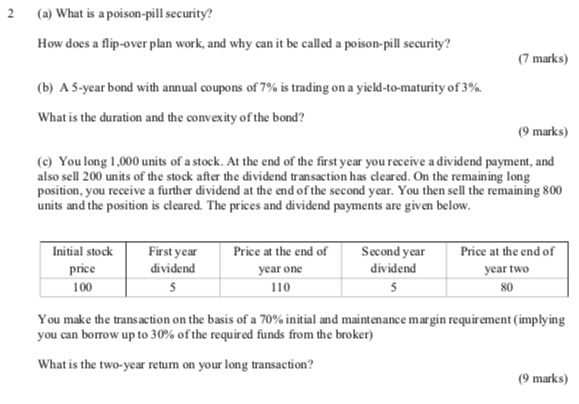

Question: 2 (a) What is a poison-pill security? How does a flip-over plan work, and why can it be called a poison-pill security? (7 marks) (b)

2 (a) What is a poison-pill security? How does a flip-over plan work, and why can it be called a poison-pill security? (7 marks) (b) A 5-year bond with annual coupons of 7% is trading on a yield-to-maturity of 3%. What is the duration and the convexity of the bond? (9 marks) (c) You long 1,000 units of a stock. At the end of the first year you receive a dividend payment, and also sell 200 units of the stock after the dividend transaction has cleared. On the remaining long position, you receive a further dividend at the end of the second year. You then sell the remaining 800 units and the position is cleared. The prices and dividend payments are given below. 100 110 Initial stock First year Price at the end of Second year Price at the end of price dividend year one dividend year two 5 5 80 You make the transaction on the basis of a 70% initial and maintenance margin requirement (implying you can borrow up to 30% of the required funds from the broker) What is the two-year retum on your long transaction? (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts