Question: 2. After performing careful security analysis, you believe that the stock of both Advanced Micro Devices (AMD) and Chipotle (CMG) are undervalued. You perform a

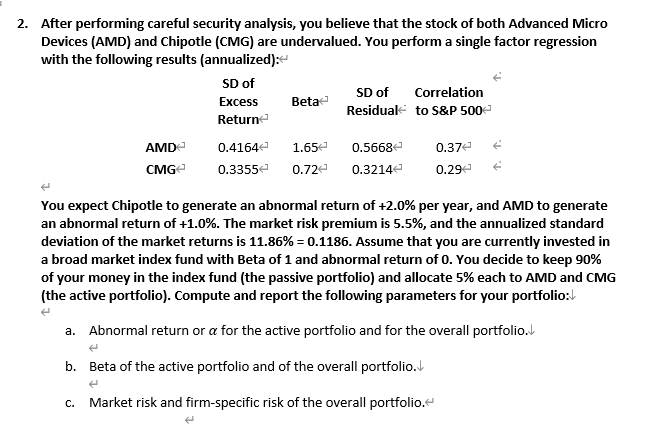

2. After performing careful security analysis, you believe that the stock of both Advanced Micro Devices (AMD) and Chipotle (CMG) are undervalued. You perform a single factor regression with the following results (annualized): SD of Excess SD of Correlation Beta- Residual to S&P 500 Return AMD 0.4164 1.65 0.56682 0.37e CMG 0.33552 0.72 0.32142 0.29 You expect Chipotle to generate an abnormal return of +2.0% per year, and AMD to generate an abnormal return of +1.0%. The market risk premium is 5.5%, and the annualized standard deviation of the market returns is 11.86% = 0.1186. Assume that you are currently invested in a broad market index fund with Beta of 1 and abnormal return of O. You decide to keep 90% of your money in the index fund (the passive portfolio) and allocate 5% each to AMD and CMG (the active portfolio). Compute and report the following parameters for your portfolio: a. Abnormal return or a for the active portfolio and for the overall portfolio. b. Beta of the active portfolio and of the overall portfolio. c. Market risk and firm-specific risk of the overall portfolio. 2. After performing careful security analysis, you believe that the stock of both Advanced Micro Devices (AMD) and Chipotle (CMG) are undervalued. You perform a single factor regression with the following results (annualized): SD of Excess SD of Correlation Beta- Residual to S&P 500 Return AMD 0.4164 1.65 0.56682 0.37e CMG 0.33552 0.72 0.32142 0.29 You expect Chipotle to generate an abnormal return of +2.0% per year, and AMD to generate an abnormal return of +1.0%. The market risk premium is 5.5%, and the annualized standard deviation of the market returns is 11.86% = 0.1186. Assume that you are currently invested in a broad market index fund with Beta of 1 and abnormal return of O. You decide to keep 90% of your money in the index fund (the passive portfolio) and allocate 5% each to AMD and CMG (the active portfolio). Compute and report the following parameters for your portfolio: a. Abnormal return or a for the active portfolio and for the overall portfolio. b. Beta of the active portfolio and of the overall portfolio. c. Market risk and firm-specific risk of the overall portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts