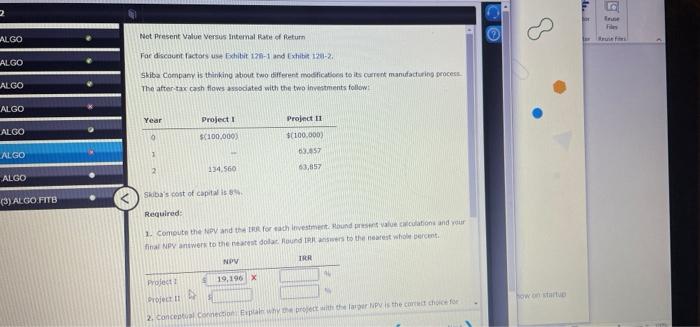

Question: 2 ALGO Net Present Value Versus Internal Rate of Return For discount factors use Exhibit 128-1 and Exhibit 128-2. ALGO ALGO Skiba Company is

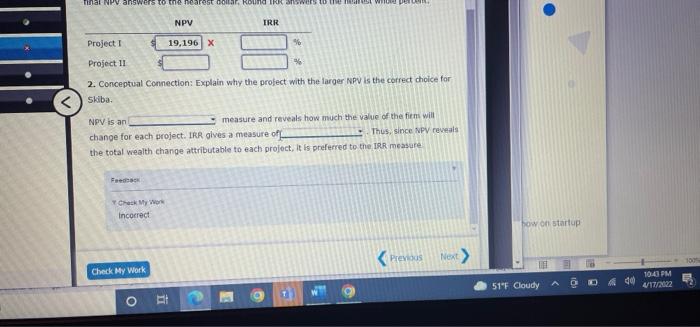

2 ALGO Net Present Value Versus Internal Rate of Return For discount factors use Exhibit 128-1 and Exhibit 128-2. ALGO ALGO Skiba Company is thinking about two different modifications to its current manufacturing process The after-tax cash flows associated with the two investments follow: ALGO Year Project I ALGO 0 $100,000) ALGO ALGO (3) ALGO FITB 2 134,560 Project II $(100,000) 63.857 63,857 Skiba's cost of capital is 8%. Required: 1. Compute the NPV and the IRR for each investment. Round present value calculations and your final NPV answers to the nearest dolar Round IRR answers to the nearest whole percent. C Inne Files NPV IRR Project Project 19,196 X 2. Conceptual Connection: Explain why the project with the larger NPV is the correct choice for how on startup

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts