Question: 2 ) Alpha and Beta Companies can borrow for a five - year term at the following rates: begin { tabular } { l

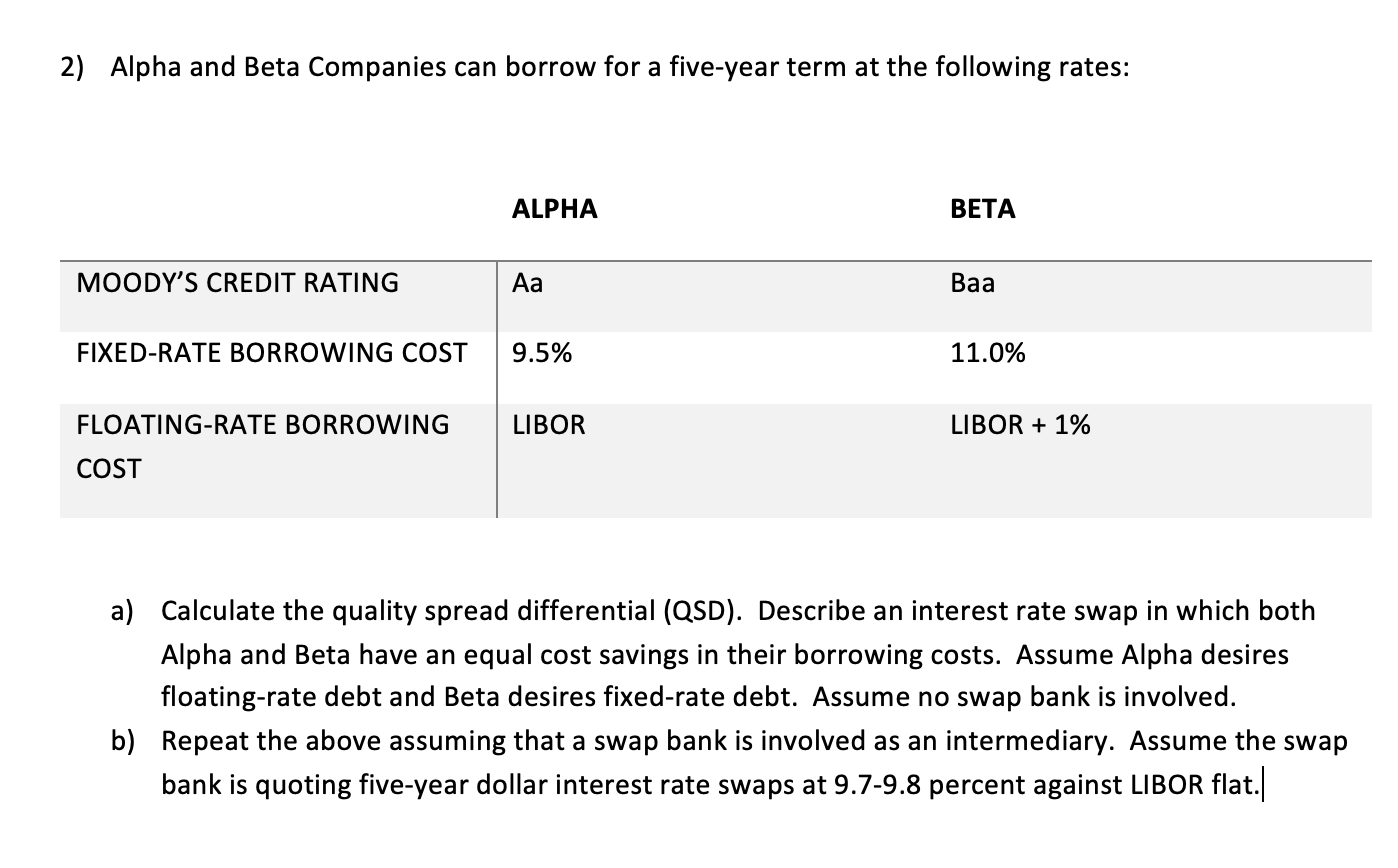

Alpha and Beta Companies can borrow for a fiveyear term at the following rates:

begintabularlll

& multicolumnc ALPHA & BETA

hline MOODY'S CREDIT RATING & Aa & Baa

FIXEDRATE BORROWING COST & &

begintabularl

FLOATINGRATE BORROWING

COST

endtabular & LIBOR & LIBOR

hline

endtabular

a Calculate the quality spread differential QSD Describe an interest rate swap in which both Alpha and Beta have an equal cost savings in their borrowing costs. Assume Alpha desires floatingrate debt and Beta desires fixedrate debt. Assume no swap bank is involved.

b Repeat the above assuming that a swap bank is involved as an intermediary. Assume the swap bank is quoting fiveyear dollar interest rate swaps at percent against LIBOR flat.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock