Question: 2) Alpha and Beta Companies can borrow for a five-year term at the following rates: a) Calculate the quality spread differential (QSD). Describe an interest

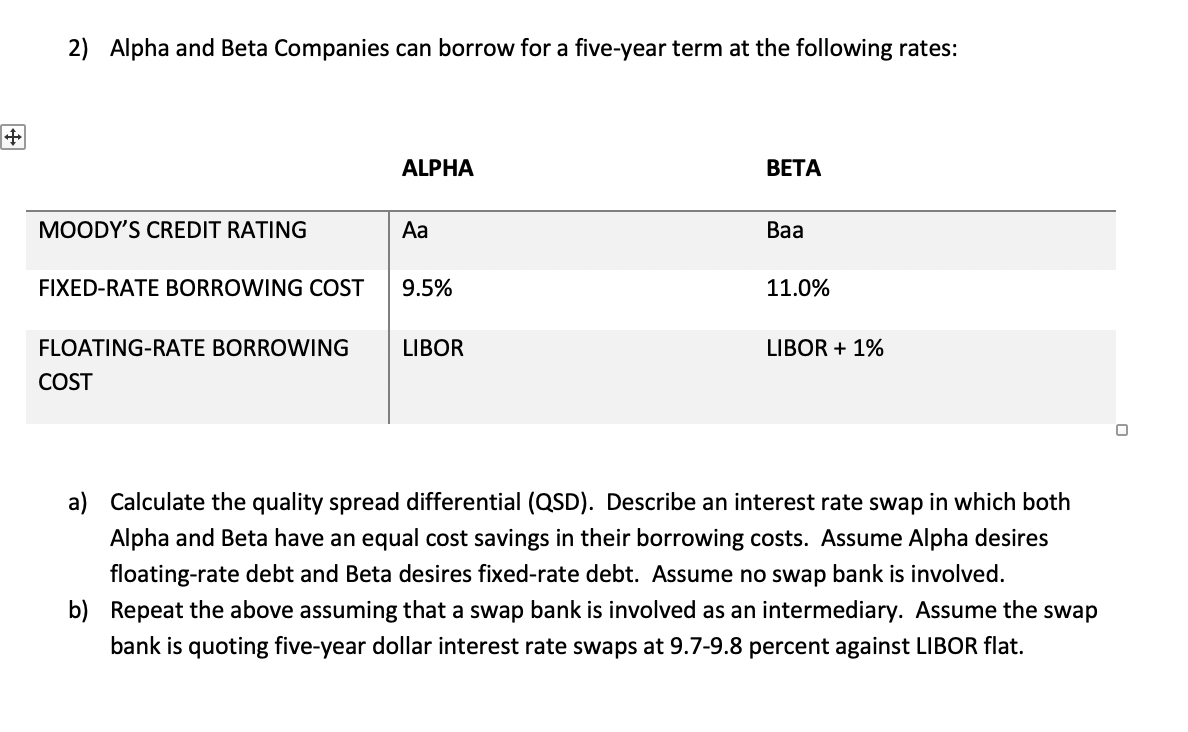

2) Alpha and Beta Companies can borrow for a five-year term at the following rates: a) Calculate the quality spread differential (QSD). Describe an interest rate swap in which both Alpha and Beta have an equal cost savings in their borrowing costs. Assume Alpha desires floating-rate debt and Beta desires fixed-rate debt. Assume no swap bank is involved. b) Repeat the above assuming that a swap bank is involved as an intermediary. Assume the swap bank is quoting five-year dollar interest rate swaps at 9.7-9.8 percent against LIBOR flat. 2) Alpha and Beta Companies can borrow for a five-year term at the following rates: a) Calculate the quality spread differential (QSD). Describe an interest rate swap in which both Alpha and Beta have an equal cost savings in their borrowing costs. Assume Alpha desires floating-rate debt and Beta desires fixed-rate debt. Assume no swap bank is involved. b) Repeat the above assuming that a swap bank is involved as an intermediary. Assume the swap bank is quoting five-year dollar interest rate swaps at 9.7-9.8 percent against LIBOR flat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts